The food industry is a massive consumer of water, using more than 70% of the world’s fresh water resources to grow crops, feed livestock, and process ingredients. Because of this, food companies are highly vulnerable to water issues, which are increasing due to climate change. So, what are these companies doing to ensure essential water resources will continue to be available into the future?

According to “Feeding Ourselves Thirsty,” a new benchmarking report from sustainability nonprofit Ceres, food companies are starting to step up when it comes to water security, but there’s still a long way to go toward sustainability.

“Water security is much more than an environmental concern. It is a financial imperative, increasingly so for the food sector and its investors,” Brooke Barton, Ceres’ VP of Innovation and Evaluation, said on a press call. “Of the 35 publicly-traded companies evaluated in our report, 77% now specifically list water as a risk factor in their financial filings, up from 59% in 2017. However, despite this growing awareness, our analysis shows that most food companies are unprepared for a water-stressed world.”

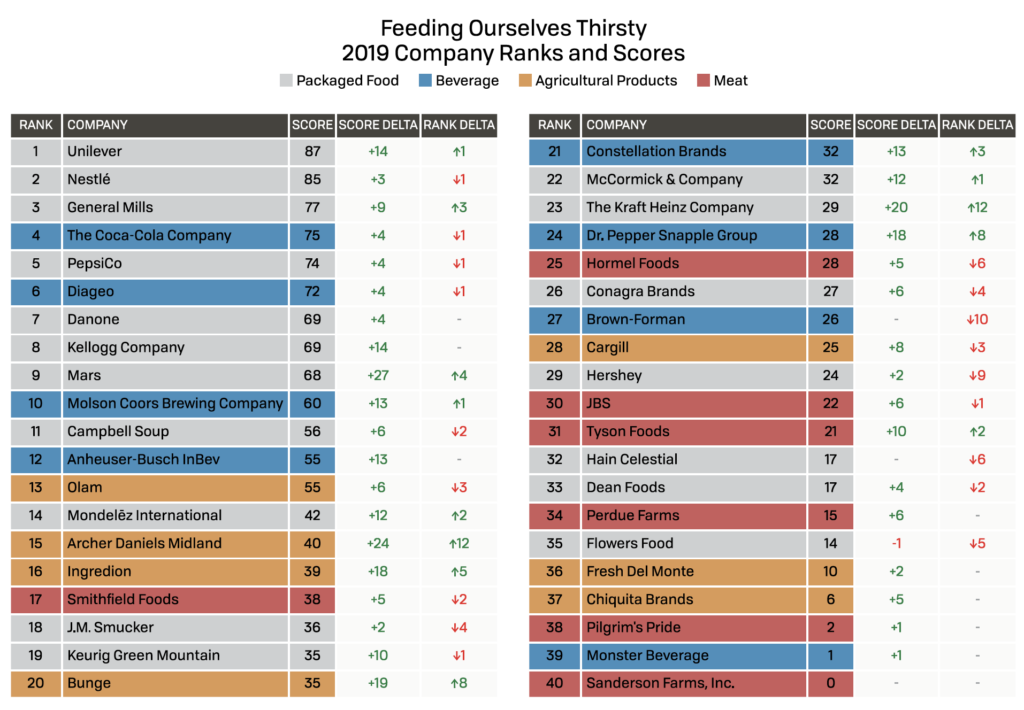

For the report, now in its third edition, Ceres evaluated and scored the water risk management practices of 40 companies in the packaged food, beverage, agricultural products, and meat industries. They reviewed multiple sources of data to score companies on four categories: governance and management, direct operations, manufacturing supply chain, and agricultural supply chain.

The results show that water security efforts in the packaged food and beverage industries are by far surpassing those in the agricultural products and meat industries. The top 12 companies on the list are either packaged food or beverage, while fewer than half of agricultural products companies and only one meat company achieved at least the average score of 38 (out of a possible 100).

Source: Ceres

Overall, the food and beverage industries have shown significant improvement since Ceres began evaluating water risk management in 2015. While the average score of 38 is still low, it’s a 22% increase over 2017 and a 52% increase over 2015.

Areas where the food industry has made major improvements:

- Corporate boards and senior executives are being charged with overseeing and managing water risks.

- More companies are setting water-efficiency targets for their operations.

- More companies are assessing water risks to their agricultural supply chains, rather than just to their facilities.

Areas where only limited progress has been made:

- Even though more companies are assessing water risks to their agricultural supply chains, those assessments are limited.

- More than one-third of companies have yet to set sustainable-sourcing goals, and for those that have, the commitments are often vague.

- Less than half of companies provide financial support to farmers to help them adopt sustainable agriculture practices.

For companies that want to up their water sustainability game, Coca-Cola, which achieved the beverage industry’s highest score, provides a great example. On the press call, Ulrike Sapiro, Coca-Cola’s Senior Director of Water Stewardship and Sustainable Agriculture, said that the company has achieved a global water balance since 2015, meaning that they generate as much fresh water volume (through wastewater recycling and other practices) as they use in their facilities.

“The impact of climate change will make the water availability stresses we have already more volatile in the future,” Sapiro said. That’s why Coca-Cola has prioritized sustainability in both their operations and their supply chain for many years.

“We have integrated advanced water management requirements into our sustainable agriculture guiding principles, which help our suppliers guide their farm suppliers on ingredient sourcing and making sure sustainable farm management practices are in place where we source,” Sapiro said. Coca-Cola currently runs an average of 300 programs globally that focus on restoring water into the environment. Sapiro cited the example of the San Joaquin Valley, where Coca-Cola has joined forces with several other organizations (including some also highlighted in the Ceres report) to protect the water supply.

This example shines a light on a critical requirement for achieving water security: collaboration. “We’re very clear that we can’t solve the global challenges of water security alone,” Sapiro said. “We need to work together with our suppliers and their farm suppliers, and of course with other manufacturing companies…to arrange a collaboration platform for sustainable agriculture and also collective action partnerships on water security and watersheds.”

These types of initiatives are invaluable. The catch is that more of the investments need to be made upfront. Implementing sustainable agriculture practices (like terraces and cover crops) can have a payoff in the long term, but it’s expensive and risky for farmers in the short term, Mitchell Hora, a seventh-generation Midwest farmer and founder of soil health consulting company Continuum AG, noted on the call. Hora advocates for a model that supports farmers by providing capital upfront, rewarding outcomes, and protecting against risk.

For companies willing to make these investments, Matt Sheldon, Senior Portfolio Manager at KBI Global Investors, has a message: you will be rewarded. Investors are starting to pay attention to companies’ sustainability efforts because they’re directly tied to long-term business success. This is especially important because several of the companies in the Ceres report are commonly-held stocks, which means their performance impacts many pensions and retirement accounts.

“Investors care because the valuation of a company is related to the robust longevity of their business profits,” Sheldon said on the call, adding that companies that set targets, focus on achievement, and work beyond their own walls to protect against water risks are more likely to offer investors better returns.

Sheldon also noted that the companies providing sustainability solutions represent additional investment opportunities. In addition to companies that provide irrigation, wastewater treatment, and other farm technology solutions, he identified three startups doing particularly interesting work in this space:

- Indigo Ag develops microbial and digital technologies that improve grower profitability, environmental sustainability, and consumer health.

- Nori provides a platform where companies can pay farmers for storing carbon in soil.

- IoT America provides Internet of Things solutions that farmers can use for soil monitoring, asset tracking, and more.

Overall, the message from the Ceres report is that the food industry is making great progress, but much more effort is needed (especially from the meat industry) to safeguard our water assets for the future. Hora put it perfectly: “We’re either all going to win or we’re all going to lose.”