Monterey, CA (April 15, 2020) — Total organic fresh produce sales were up 22 percent for the month of March, with overall first quarter sales up eight percent in retail conditions unlike any ever experienced in the modern era of grocery retailing, according to the 2020 Q1 Organic Produce Performance Report released exclusively by the Organic Produce Network and Category Partners.

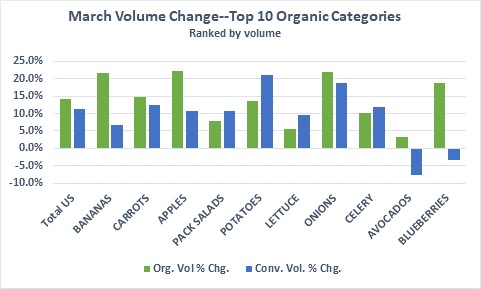

Unprecedented consumer purchasing behavior across the United States because of COVID-19 emptied store shelves, resulting in widespread out-of-stock conditions. In March, total organic dollars were up 22 percent from March of last year and significantly above the dollar increase of January and February of this year, which stood at 1.8 percent. Data shows organic fruits and vegetables out-performed conventional products in produce departments the first three months of the year, with dollar sales of organic fruits and vegetables increased by 8 percent, and volume up by 10 percent. Conventional fruits and vegetables grew by 6.6 percent in dollars and 7.7 percent in volume.

The 2020 Q1 Organic Produce Performance Report utilized Nielsen retail scan data covering total food sales and outlets in the United States over the past 13 weeks, with an extra examination on March sales.

“Organic fresh produce sales in the first quarter of the year were strong, and the impact of COVID-19 in March pushed numbers even more,” said Matt Seeley, CEO of the Organic Produce Network. “And we continue to see organic fresh produce sales outpace the dollar and volume growth rate of conventional fresh produce.”

“Organic fresh produce sales in the first quarter of the year were strong, and the impact of COVID-19 in March pushed numbers even more,” said Matt Seeley, CEO of the Organic Produce Network. “And we continue to see organic fresh produce sales outpace the dollar and volume growth rate of conventional fresh produce.”

“The West continues to be the strongest region in the US for organic performance, with first quarter 2020 ACV performance 34 percent the US average,” said Seeley. The 2020 Q1 report indicates that the West and Northeast shared the greatest increase in organic dollars. Moving forward, the largest opportunity for organic growth appears to be in the Midwest and South regions.

Steve Lutz, senior vice president of Insights and Innovation at Category Partners, says a challenge and opportunity for the industry is in broadening the base of organic retail volume. “What we see in the Nielsen data is that organic produce at retail is concentrated within fewer categories than conventional produce, especially in the winter months when locally produced organic products are less available,” said Lutz. “The top 10 organic categories in produce drive 59 percent of dollars and 71 percent of volume in Q1. These same categories contribute only 42 percent of total conventional sales and 52 percent of volume.”

Steve Lutz, senior vice president of Insights and Innovation at Category Partners, says a challenge and opportunity for the industry is in broadening the base of organic retail volume. “What we see in the Nielsen data is that organic produce at retail is concentrated within fewer categories than conventional produce, especially in the winter months when locally produced organic products are less available,” said Lutz. “The top 10 organic categories in produce drive 59 percent of dollars and 71 percent of volume in Q1. These same categories contribute only 42 percent of total conventional sales and 52 percent of volume.”

Packaged salads, apples and bananas generated the highest dollar growth in organic dollars in the first quarter, generating over 35 percent of total organic produce dollar growth. In terms of volume, bananas, carrots and apples lead, generating 44 percent of total organic volume, with bananas increasing volume growth by a remarkable 19.5 percent.

Seeley believes the data is indicative of the importance of organic produce, perhaps even more in these unchartered times. “Our nation is understanding the importance of the selfless dedication the farming and grocery industry is doing day in and day out,” he said. “Consumers are looking for items they trust during these uncertain times and organic fresh produce is a healthy and safe option for all consumers.”

The full 2020 Q1 Organic Performance Report is available on the Organic Produce Network website at https://www.organicproducenetwork.com/education

# # #

OPN is a marketing organization serving as the go-to resource for the organic fresh produce industry. The company’s mission is to inform and educate through a strong digital presence with an emphasis on original content and complimented by engaging live events which bring together various components of the organic food community. The OPN audience includes organic producers, handlers, distributors, processors, wholesalers, foodservice operators and retailers. www.organicproducenetwork.com

Cate Aldrete

Tradeshow/Marketing Manager

Ph: (831) 884-5058

Fax: (831) 901-3135

[email protected]