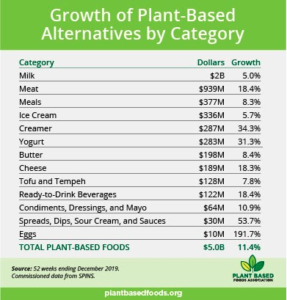

In 2019 U.S. retail sales of plant-based foods grew by 11.4%, to a total market value of $5 billion. In comparison, total sales in the U.S. retail food market increased 2.2%. The data comes from a report commissioned by the Plant Based Foods Association and the Good Food Institute based on statistics from SPINS.

Over the past two years, U.S. retail dollar sales of plant-based foods grew 29%, compared to 4% for total food dollar sales.

Plant-based milk and dairy

Plant-based milk leads plant-based food sales, making up 40% of the category. Annual sales went up 5% to $2 billion. The most purchased plant milk is almond milk. However, oat milk is growing rapidly, increasing 686% in 2019. Also, plant-based milk makes up 14% of the entire milk category, while cow’s milk sales stagnate.

In other dairy alternatives, plant-based creamer reached $287 million in sales and yogurt was up to $283 million. Both grew more than 90%.

Plant-based meat

The plant-based meat category grew 16% in 2018 and 18% in 2019 to reach $939 million. Sales are expected to exceed $1 billion in 2020. Driving growth is refrigerated plant-based meat, which was up 63%, and now makes up a one-third of plant-based meat sales. Frozen plant-based meat grew only 4% in 2019 and the conventional meat category grew 3%.

The report notes the increase in refrigerated sales highlights new industry innovation by manufacturers and new merchandising strategies by retailers. Refrigerated plant-based meat is increasingly sold in the refrigerated meat case. Plant-based meat now accounts for 2% of retail packaged meat sales.

Plant-based burgers are the top-seller, followed by sausages and hot dogs and then chicken and breakfast patties.

The following table shows all plant-based sales growth by category:

Source: https://plantbasedfoods.org/plant-based-foods-retail-sales-data-2020/

Plant-based motivations

Why are consumers buying more plant-based foods? Hartman Group’s Food & Technology 2019 report looked at consumer motivations in making eating choices:

- Taste and discovery: what’s good to eat

- Health and wellness: what’s best to eat

- Cost and convenience: what’s possible to eat

- Ethics and beliefs: what’s right to eat

The top motivating factor for buying plant-based foods was taste and discovery. Many consumers love novelty and want to try new flavors and cuisines. The next most important factor was health and wellness, with consumers seeing plant-based foods as central to a healthy meal. Though further down the list, cost/convenience and ethics/beliefs still showed up as important factors.

Even with consumer motivation and increased sales of plant-based foods, Hartman warns that consumers are already questioning some of the health claims. A number of sources, including Harvard Health News, caution “meatless burgers are heavily processed and high in saturated fat.”

Also, consumers may sense companies can use plant-based language and imagery to overemphasize vegetable content or to stifle inquiry about problematic ingredients or questionable production methods. As a result, Hartman warns the term “plant-based” could become as fuzzy and meaningless as the word “natural.”