Overall, food and beverage manufacturers are moving toward pre-COVID-19 levels of production, according to Plex Systems, Inc, which offers a smart manufacturing platform. However, food companies are having varied experiences depending on the specific company and food sector, and whether a company sells primarily to foodservice and restaurants or to grocery stores, according to Brad Hafer, Group VP, Corporate Development at Plex.

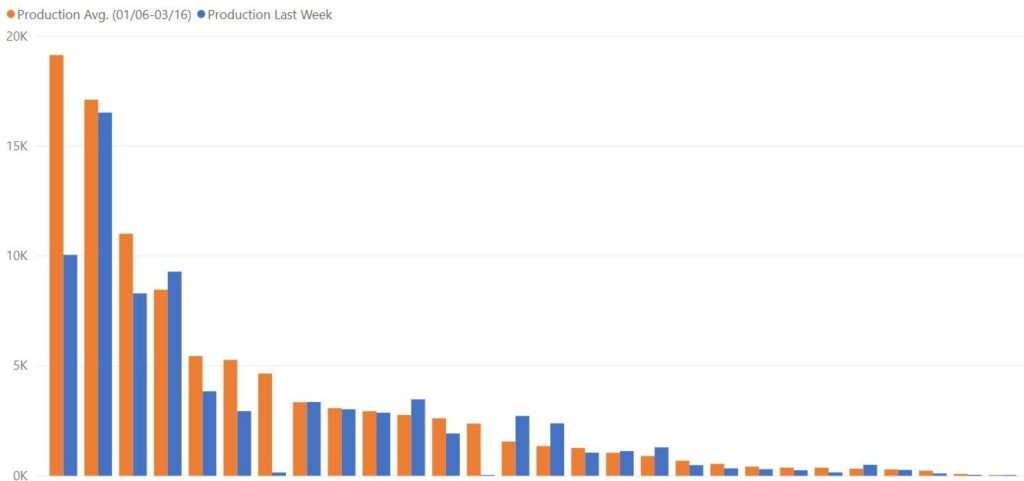

Plex sees two distinct experiences: Companies that are matching or exceeding pre-COVID-19 production levels and those that continue to produce at lower levels. The following chart shows anonymized data for a sampling of companies. (Blue is production for the week of May 4, 2020, and orange is average pre-pandemic production.)

Companies producing at or above pre-pandemic levels include individual frozen food co-packers, commercial bakeries, and businesses that have pivoted production to make products like hand sanitizer. Big food brands that sell high-demand products to grocery store chains have also expanded production to meet demand. Plus, regional suppliers and plant-based alternatives are seeing increased business during the pandemic, reports Forbes.

Some companies have been able to adjust and increase sales using their supply chain planning tools. For example, spice-maker Olde Thompson picked up three new customers after the customers’ other suppliers weren’t able to meet demand. “[The company was] able to respond and adjust their inputs and sources of supply into their production scheduling and were able to meet their current customer demand and then backfill for demand the competitors couldn’t meet,” said Hafer.

However, companies that sell mostly to the foodservice and restaurant industry remain hard hit by restaurant closures. Because the foodservice industry needs different types and quantities of products than grocery stores, processors face significant obstacles as they attempt to change direction, especially in regard to packaging and transportation, according to AgWeb.

This bifurcated food system — restaurant and grocery — means farmers supplying beef or produce to grocers may have a shortage while a neighbor supplying restaurants is killing surplus livestock or plowing produce back into the field. Hard hit agriculture includes potato farmers because most of their crops go to restaurants for french fries. Dairy farmers are also struggling, as about half of their milk goes to restaurants and 10% to 15% to schools and institutions.

Also affecting meat farmers is the closure of many meat processing plants. As of May 21, at least 15,800 reported positive cases of COVID-19 have been tied to meatpacking facilities in at least 193 plants in 32 states. The result is the expected culling of millions of animals and possible meat shortages

Another issue is the effect of sick farmworkers on food production. Purdue University, in collaboration with Microsoft, just released the Food and Agriculture Vulnerability Index “to quantify the potential risk to the supply of agricultural products as a result of farm and agricultural worker illnesses from COVID-19.” The Index breaks down risk by county and crop.

Will the situation improve soon? “While the data and indicators we have are reassuring, we are dealing with an unprecedented crisis and there are many unknowns that could shape the situation in the next few weeks,” states the USDA.