In “The Birth of a New Food or Beverage Product,” we explored the process behind creating and bringing new products to market. And whether this is by a start-up with its first product or a multinational company adding to an already established brand, an average of 20,000 new food and beverage products are launched every year.

Time will tell if that number holds for 2020. The year started out with business as usual, where consumers could browse full shelves at the grocery store and almost be guaranteed that they would find what they wanted – even if that was something as simple as rice.

In the new normal, consumers are faced with empty shelves and limited choices. Plus, the shopping mindset is more “grab and go” rather than a leisurely search to find something new. And remember all of those new product sample stations that sometimes served as lunch? Well, that’s not happening now.

It is obvious that consumer behavior has changed since March. But what does that mean to food producers that were set to launch new products or have seen their R&D department forced to work from home?

The team at Mattson, a company that helps innovators develop new products from concept creation to commercialization, had the same questions. In April they surveyed food and beverage professionals to find out how industry insiders believe that COVID-19 might impact the future of food innovation, development, launch, and success with retail customers and consumers. The study results were discussed in a recent webinar hosted by the company.

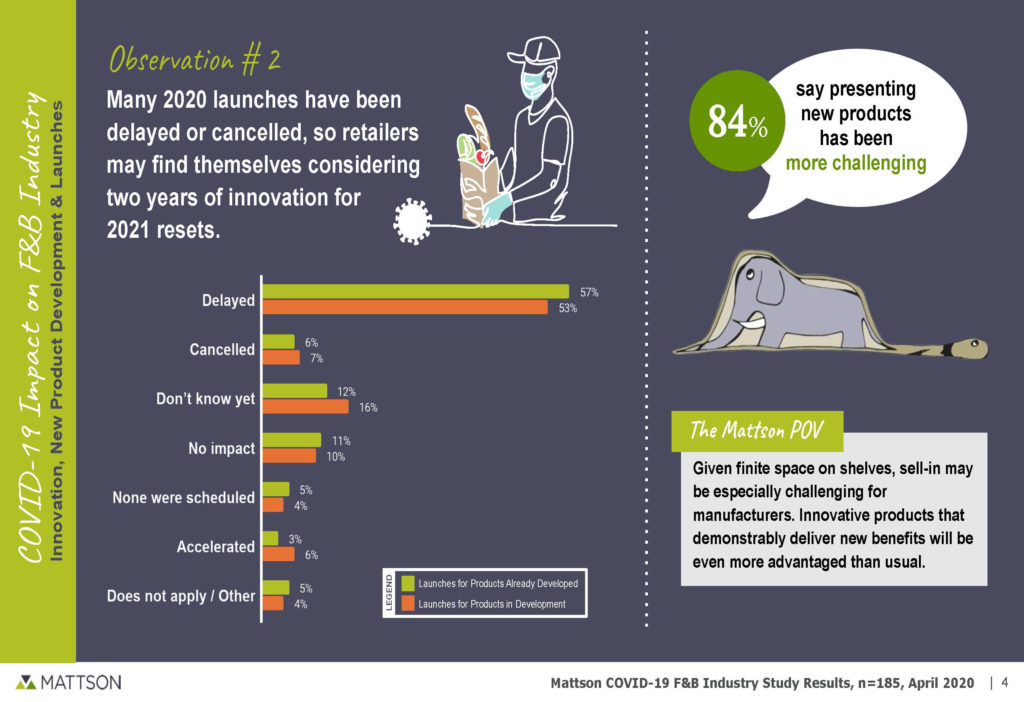

The good news is that while the majority of survey respondents are approaching innovation in a new way, more than two-thirds are either working on new concepts or developing new products. Just don’t look for a plethora of these to hit the grocery shelves in the coming months. Again, about two-thirds of those surveyed indicated that 2020 launches have been delayed, cancelled, or are in limbo.

Keith Belling, founder & CEO of Right Rice and founder of popchips, has real-time experience with COVID-19’s impact on new products. He told Mattson’s webinar audience that he has seen a mixed response from retailers as the pandemic hit during the launch of Right Rice Medleys.

“I think, first of all, it depends on the retailer and it depends on the innovation and the product,” Belling said. “But at the end of the day, there are retailers we work with that are incredibly responsive and excited about meeting under a different format, so it’s Zoom meetings and the like. Others have been really clear and let us know that even though we had something set up they are going to hold it off and do it later in the fall.”

Understandably, food retailers are focused on customer and employee safety and keeping products on the shelves, which can put adding new products to the line-up on the back burner.

“I think it’s kind of the reality of the situation and a matter of focus for the retailers,” Belling said. “It’s our job as a brand and as entrepreneurs to [incentivize] them [retailers] to talk to us and to move forward.”

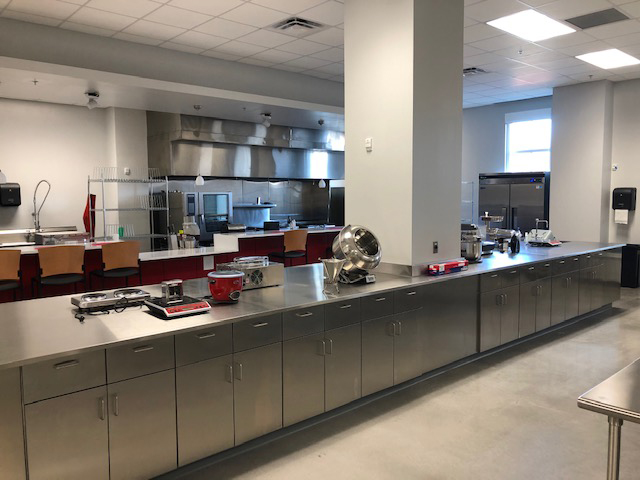

Bill Aimutis, executive director of the North Carolina Food Innovation Lab, a food manufacturing pilot plant dedicated to accelerating plant-based food research, development and commercialization, has seen a similar response. “Retailers, and even consumers to some extent, have been reluctant to stock, purchase, or try new products,” he said. “Another factor influencing new product availability is that food processors have been producing their most operationally efficient products to maintain replenishment in the supply chains, and co-manufacturers have done the same, making it difficult for start-ups to have their products manufactured.”

Rediscovering the home kitchen

In its report Food Study Special Report, America Gets Cooking: The Impact of COVID-19 on Americans’ Food Habits, HUNTER found that about 50% of Americans are cooking and baking more, have more confidence in the kitchen, and expect these facts to be the new normal.

Everyday life for the majority of Americans began to look completely different in March. People are working from home and children are not attending school or related activities, which frees up time. Layoffs, reduced hours, and salary cuts contribute to the need to reduce spending. And since “the village” has shrunk to those living in your home, cooking brings an element of community into the kitchen.

“In our survey, many respondents cite that consumers are learning to enjoy cooking and family meals,” said Al Banisch Mattson’s EVP, New Product Strategy & Insights. “I envision that the real benefit is the social aspect of cooking with families in the kitchen together.”

All of this change influences the way consumers fill their carts as they traverse the now one-way store aisles.

“Consumers don’t shop categories, they shop needs,” said John Haugen, Founder & Managing Director of 301 INC, the venture capital business unit within General Mills noted during Mattson’s webinar. “There has been a fundamental change in the way consumers think about food.”

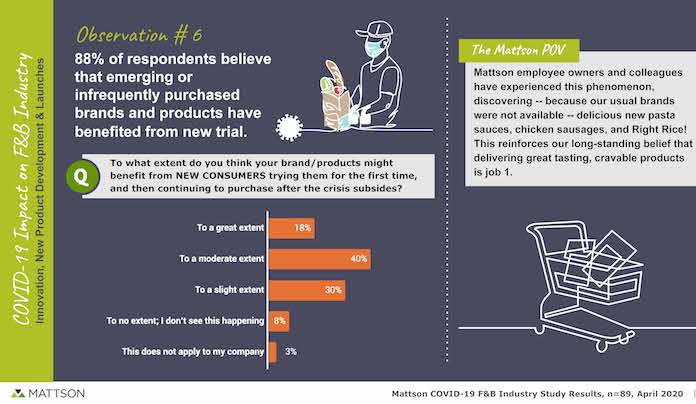

Some of this thinking by consumers has been driven by availability. HUNTER’s study shows that 44% of the respondents have discovered new ingredients and 50% have discovered new brands and products. Due to the recent run on staples, such as rice, new products just might find their way into the shopping cart.

This is exactly what Belling has seen in countless messages from customers as to how they “found” Right Rice because it was all that was left on the shelf.

“My favorite message was from a woman in Portland, OR, telling how she went to grab rice at the store and there nothing was there [on the grocery shelf]. So, she grabbed Right Rice because that was all that was left,” Belling said during Mattson’s webinar. “She said she was so nervous to try it, but ended up loving it and went back to the store the next day to buy every bag on the shelf.”

This is exactly what Mattson’s survey found, with 88% of respondents saying that, at least to some extent, brands/products might benefit from new consumers trying them because of availability and then continuing to purchase after the crisis.

“I know this first-hand,” Banisch said. “In early April, I was looking to purchase a jar of our usual pasta sauce, but it was gone and the grocery shelves were almost empty. On the top shelf there were some jars of a private label brand, so I tried it. It turned out to be one of the best pasta sauces we had ever had from a jar, so on the next trip to the store I bought that same brand. This reinforces our [Mattson’s] long-standing belief that delivering great tasting, craveable products is job one.”

COVID-19 – The fertilizer for growth?

Prior to the pandemic, plant-based foods were growing roots, according to SPINS retail sales data released March 3, 2020. Their data shows grocery sales of plant-based foods that directly replace animal products have grown 29% in the past two years to $5 billion. S2G Ventures’ recent report Everyone Eats – The Future of Food in the Age of COVID-19 predicts that the plant-based market is projected to grow to $14.2 billion by 2022.

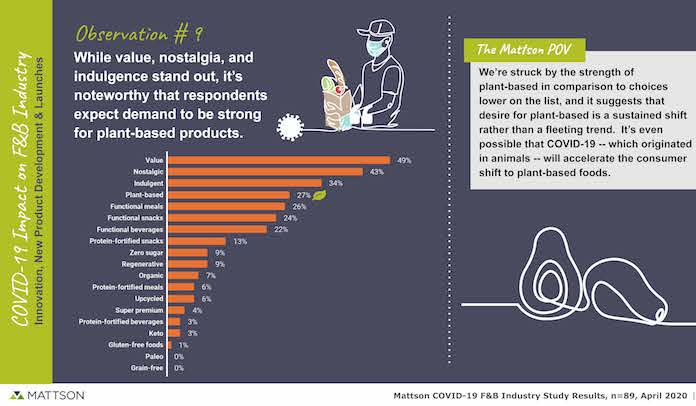

The industry insiders responding to Mattson’s survey also see plant-based foods in a positive light when asked what factors they see as the greatest influence to driving consumer demand.

“While value, nostalgia, and indulgence stand out [as the top three drivers], it’s really noteworthy to us that respondents expect demand to be strong for the fourth one on the list — plant-based products,” Banisch said. “It suggests that desire for plant-based is a sustained shift rather than a fleeting trend. It’s even possible that COVID-19 — which originated in animals — will accelerate consumer shifts to plant-based foods.”

On the KerryDigest Blog, Fiona Sweeney, Strategic Marketing Director of End Use Markets for Kerry Taste & Nutrition, shared her insights on the subject: “Plant-based foods are already accelerating in terms of their growth because consumers are looking for products that will help them maintain a healthier lifestyle, but also products that are kinder to the environment and kinder from an animal welfare perspective. We do expect the COVID pandemic will lead to an acceleration of consumers considering this flexitarian or vegetarian lifestyle. So, considering how you might build a plant-based product into your portfolio to give that consumer option[s] is definitely something we would consider.”

A recent AgFunder Digitalk discussed other drivers behind why alternative protein innovation could get a boost from the pandemic.

“There’s an asymmetrical relationship between just-in-time inventory that groceries rely on” and the “long-cycle production for animal meat, where it takes months and years to produce,” noted Dan Ripma, senior associate, S2G Ventures. “Centralized meat processing also presents pathogen risks, further indicating that the COVID-19 crisis is a potential catalyst for innovation in cellular protein, plant-based protein, algae, fungus, and other biomass concepts.”

Bottom line

Even when all the right elements are in place and there is a great-tasting product with a solid team behind it, retailers willing to stock it, and consumers ready to purchase, without funding it will never move from the test kitchen to the consumer’s kitchen.

Pre-COVID, there was a tremendous amount of capital to invest across the board with the interest in food and beverage rising. Investment has slowed over the last couple of months as investors take a look at their portfolios and make some hard decisions.

“On the positive side, investors who have money are still interested in food and agtech the same as before,” said Adam Bergman, managing Director of EcoTech Capital. “But now there will be less capital to invest in new companies as investors are taking a look at current portfolio companies to decide which ones are going to survive and which ones are not.”

In other words, they’re deciding which companies are going to continue receiving investments to keep them viable in the altered food and beverage landscape. Issues such as supply chain challenges and decentralization must be addressed so the food and beverage industry is more robust in the future.

“There is an increased push for robotics and automation so processors can go to market in a world where social distancing is necessary,” Bergman noted. “When we get to times like today, it is necessary for companies to be laser-focused on building a viable business, understanding that capital is not unlimited, and [showing] a path to profitability in the short term.”

“Entrepreneurs should take this opportunity to finely hone their pitch decks and their ability to demonstrate how they react in a crisis to investors,” Aimutis advised. “Start-up investing is not so much about the product, but about the team behind it. The commitment and tenacity of founders is imperative to investors.”

Grocery shelves in the new normal

Just a few months ago, a trip to the grocery store didn’t have the concerns of waiting in line, health risks, or empty shelves. Now consumers are becoming conditioned to expect, if not accept, these situations and feel victorious when they can get most of the items on their shopping lists. So, what will grocery stores look like in the coming months and beyond?

There are many unknowns as to how COVID-19 will affect the average 20,000 new food and beverage products launched every year. About half of Mattson’s survey respondents expect that retailers will be eager to bring in new products. Respondents were a little more conservative as to how consumers will react to new products, with 39% seeing an immediate demand.

“I see a lot of pent up innovation – more in pipeline than ever before,” Banisch said. “I believe there will be demand from both retailers and consumers. The consumer will have the mindset of wanting to celebrate life and try something new after months of monotony. Retailers need to act quickly to meet this latent demand.”

“Retailers can either lead with innovation or lean into what they know,” Haugen said.

Industry insiders agree that new products need to be really new products. This is not a good time for lines and flavor extensions as retailers will be selective in choosing the ones that are most unique and exciting.

“Now is the time to think creatively about the industry’s future directions and to design product offerings to accommodate jobs-to-be-done by looking at what products are missing in the market from both the consumer and retailer perspective,” Aimutis said. “Start with a list of deficiencies to see what is missing and look for a gray spot for your product.”

Aimutis adds a cautionary note to entrepreneurs: “Consumers’ attitudes about want versus need have changed during this pandemic, and may influence where investors allocate money and what consumers purchase. Consumers will cautiously spend disposable income in the future after millions experienced staff furloughs or reductions. New products will need to address need.”

And remember, no matter where a new food or beverage product fits in, to make it from the grocery store shelf to the consumer’s cart time after time, it has to taste good!