Consumers already had an interest in functionality before the COVID-19 pandemic. Because of the pandemic, 31% of consumers are taking more supplements and 29% are consuming more functional foods/beverages, according to the Functional Food & Beverage 2020 Report from the Hartman Group, based on research done in April.

Hartman believes this surge in the use of functional food/beverages and supplements will become a long-term change in consumers’ daily behaviors.

In a webinar featuring highlights from the report, Laurie Demeritt, Hartman CEO, said she believes two consumer reactions and adaptations to the pandemic will have long-lasting positive effects in the functional market. The first is a focus on personal empowerment that includes taking control of personal health. The second is the new emphasis on physical and mental resilience going forward. These changes are likely to create new opportunities for functional products.

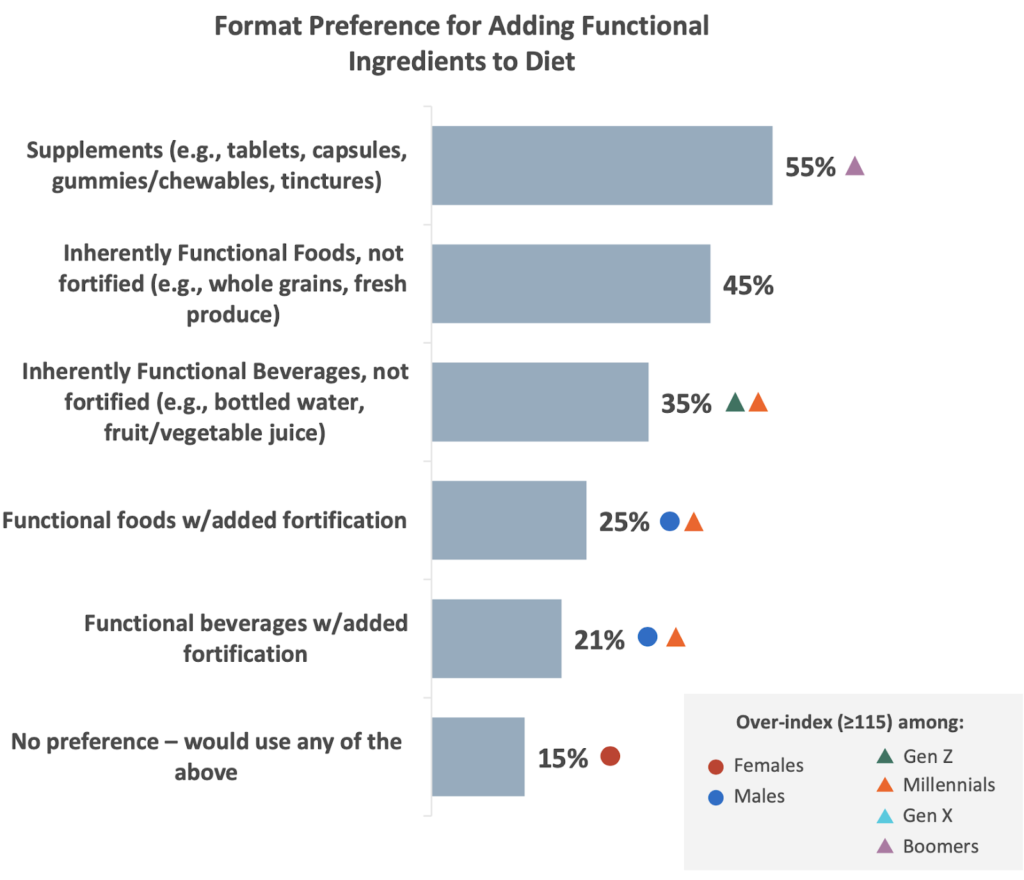

Consumers use supplements, functional foods, and functional beverages along a continuum. For supplements, that means choosing from a range of products, from those with more scientific backing to formulations using traditional or alternative remedies. Historically, consumers wanting functional benefits have chosen supplements. Fifty-five percent of consumers still say they prefer supplements for adding functionality to their diets.

For food and beverages, the continuum is from inherently functional foods and drinks to scientifically fortified products. More consumers prefer inherently functional foods because fortified products can mean processed food with artificial ingredients, isolates, stabilizers, etc.

Source: Functional Food & Beverage 2020 Report

Hartman asked consumers why they use supplements, functional foods, and functional beverages. The following table shows the top six reasons for each category.

| Supplements | Functional Foods | Functional Beverages |

| Immunity | Energy | Hydration |

| Bones/Joint Health | General Prevention | Energy |

| General Prevention | Weight Management | General Prevention |

| Skin/Hair/Beauty | Cardiovascular/Cholesterol | Digestion/Microbiome |

| Energy | Digestion/Microbiome | Immunity |

| Digestion/Microbiome | Immunity | Fitness/Performance or Weight Management |

Although the order of the reasons for using functional products varies by category, running through all the categories are immunity, energy, general prevention, and digestion/microbiome.

“We’ve seen a long-term trajectory in terms of the rise of immunity as an area of interest for consumers, but certainly what’s happening in the current environment has really pushed that up to the top,” said Demeritt.

What do consumers look for when choosing functional foods/beverages? Even when functionality is a priority for consumers, they want good taste and real, natural food. Although natural is a subjective word, for most consumers, it means the ingredient list is generally clean and short, with recognizable items. Also important are no artificial colors, flavors, and preservatives; less processed; low/no added sugar; and reasonable price.

The most successful products are likely to be ones that support health and wellness while also addressing consumer constraints around time, energy, money, and daily routines, notes the Hartman report.

Consumer desire for functional products is robust and evolving. To stand out from the crowd, supplement makers must go beyond standard quality measures to being transparent about ingredient purity, states Hartman. Supplement makers also need to consider offering non-pill products. Producers of functional foods and beverages need to focus on the primary goals of delivering on sensory experience (especially taste) and consumer definitions of quality.