The competitive landscape for foodservice will change after Covid

In many countries, including those in Europe and North America, Covid-related disruptions remain the most relevant driver of foodservice performance in the near term. The pandemic has accelerated several strategic elements of the foodservice industry, which will continue to drive agendas even after the current crisis ends.

As vaccinations and treatment advance, the focus of attention for foodservice operators will shift from near-term recovery to more strategic matters. According to a recent Rabobank report, the most relevant performance drivers over the next 6 to 12 months will be the pace of revenue recovery beyond restrictions, the influence of government stimulus, and cash flow challenges.

These drivers point to a challenging operating environment for the foodservice industry, particularly for smaller operators. “Many of these operators may not survive the current disruptions, leading to a materially different industry landscape compared to pre-Covid. However, the final number of closures could be lower than what was originally feared as new capital steps in to take advantage of new opportunities,” according to Amit Sharma, Senior Analyst – Consumer Foods at Rabobank.

Since March 2020, a number of companies have changed hands following difficulties that were often pre-existing and then amplified by the pandemic. The targets include operators of all sizes, and the buyers include strategic investors and financial sponsors using the opportunity to expand or build up platforms. Meanwhile, deals triggered by more commonplace drivers, such as gaining scale, diversification, or opportunities to create platforms, also took place in 2020. “When the crisis is over, the competitive landscape will be different from that of 2019 and include larger operators that are financially stronger and more technologically advanced than those that left,” says Maria Castroviejo, Senior Analyst – Consumer Foods at Rabobank.

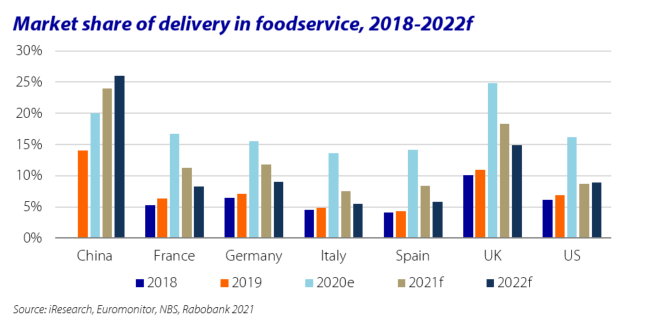

Moreover, Covid has accelerated and, in some cases, triggered many strategic elements of the foodservice industry, which will continue to drive agendas even after the current crisis has come to an end. Delivery – even with all the uncertainties around its eventual shape and size – is one of them. For a large majority of restaurants, delivery is becoming a necessity as many newly acquired buying habits may persist after the current crisis and new operators may make delivery an integral part of their business model. Unsurprisingly, large delivery platforms/aggregators have benefited the most of the ongoing surge, adding record numbers of new restaurants and users to their platforms, posting strong sales growth, getting higher valuation/share prices, and attracting new investments. According to Rabobank, delivery’s share of foodservice sales may have peaked, at least for the next several years, although it will remain above pre-pandemic levels, as foodservice sales rebound and on-premise eating recovers when restrictions are lifted.

Looking into the longer term it’s sustainability, in a broad sense, that may extend the farthest and result in more transformational changes at all levels, as a combination of regulatory and corporate purpose-driven choices determine future investments and operational choices. “Pressure from consumers, regulators, management, and investors returned in 2H 2020 and has accelerated announcements of targets and innovations related to sustainable packaging. Plastics, waste, and carbon footprint remain in focus,” concludes Castroviejo.