Consumers are done with trade-offs. Several recent reports have shown that consumers are no longer satisfied with choosing between things like taste and functionality, or convenience and sustainability. They want food and beverage products that meet all of their needs. And with the increasing trend toward humanization of furry friends, consumers are applying the same principles when buying food and treats for their pets.

Based on the data in engineering, architecture, construction, and consulting firm CRB’s latest Horizons report, the pet food industry is well positioned – or at least in the process of becoming well positioned – to meet these needs, even as the demand for pet food continues to soar thanks to the high level of pet adoption during the pandemic. From product, processing, and packaging innovations to sustainability and food safety, pet food and treat manufacturers are investing in new ways to increase both production capacity and the quality of their products.

Values take center stage, even as headwinds remain

Like most manufacturing industries, pet food is facing a number of challenges, as they have been for the past few years.

Top 5 business drivers

- Expectations for manufacturing practices and workplace environments

- Increased pet ownership/product demand

- Labor availability

- Humanization

- Inflation pressure/costs

Note: The survey was conducted in December 2021, so it’s possible that the rankings of some factors, such as inflation, have changed.

However, despite these challenges, pet food manufacturers are prioritizing values like quality and sustainability above other financial drivers, Tony Moses, CRB’s director of production innovation, said in an interview.

Top 5 product innovation drivers

- Sustainability

- Improving product consistency

- Achieving a cleaner label/ingredients

- “Pets as family” considerations

- Reducing selling price

“In the CPG world, there are a lot of business headwinds right now,” Moses said. “I think that the pet food industry is feeling that, but they’re still being very ambitious with their production philosophy, their products, their packaging.”

Moses noted in particular the drive toward sustainability. Almost nine in 10 respondents in CRB’s survey said they’re working toward formalized sustainability benchmarks, and 94% are aiming for carbon neutrality, which Moses called “an amazing target for such a protein heavy industry.” In fact, many manufacturers are considering changing their protein source away from animal proteins in the next five years, at least partly as a way of being more sustainable.

Innovations in processing and packaging

Pet food manufacturers estimate that they will invest an average of $13 million in processing equipment or process support utilities over the next three years. The largest group (roughly 40%) expects to invest between $5 million and $10 million, which is about equivalent to a new processing line.

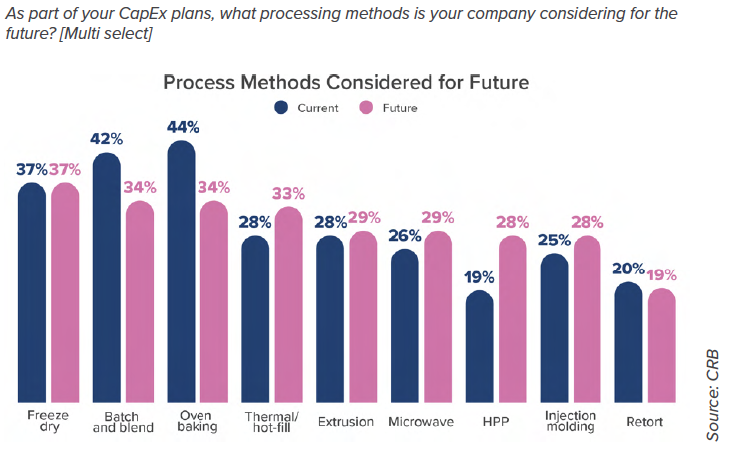

CRB asked respondents what processing methods they use now and what they are considering for the future. The biggest changes, such as a decrease in oven baking and an increase in both thermal/hot-fill and high-pressure processing (HPP), indicate a shift toward more raw or fresh ingredients.

“What we think is happening with humanization is a move toward raw or fresh ingredients,” Moses said, noting that the planned investments suggest manufacturers are getting “ready for that slow, steady march toward raw products and less processed products.”

On the packaging side, 83% of respondents plan to change their packaging.

Top 5 new packaging types being considered

- Resealable retort pouch

- Stand-up zipper pouch

- Plastic bottles

- Squeezable retort pouch

- Glass jar

“What struck me most was that the five most commonly picked choices were, I think, more about consumer convenience rather than cost savings,” Moses said. This demonstrates that “despite those challenging headwinds, [pet food manufacturers] are really focused on what the consumers want.”

A focus on food safety

Underlying all of the anticipated changes and investments is a focus on food safety. Food safety was the top driver of packaging changes, and the ability to meet the food safety plan was the top driver of capital projects. “That’s above things like cost of project, schedule, expertise of the executing company,” Moses said. The report notes that most pet food companies they work with have the same hygienic standards as human food factories.

To achieve this, companies are investing in new procedures that represent significant jumps in facility hygiene for the industry as a whole, including dedicated personnel entrances for different production areas, dedicated hygiene exchange rooms to process areas of the plant, and captive shoe programs (shoes remain in dedicated areas on site). “Those three things are what I would call emerging best practices in the industry,” Moses said, noting that the results were a pleasant surprise. “I think some of it is that the values that are being reflected in the food are also starting to get reflected in the manufacturing environment.”

Automation and digitalization to improve operational efficiency

Given the numerous challenges pet food manufacturers are trying to address all at once, it’s not a surprise that they’re increasingly turning to automation and digitalization to drive efficiency.

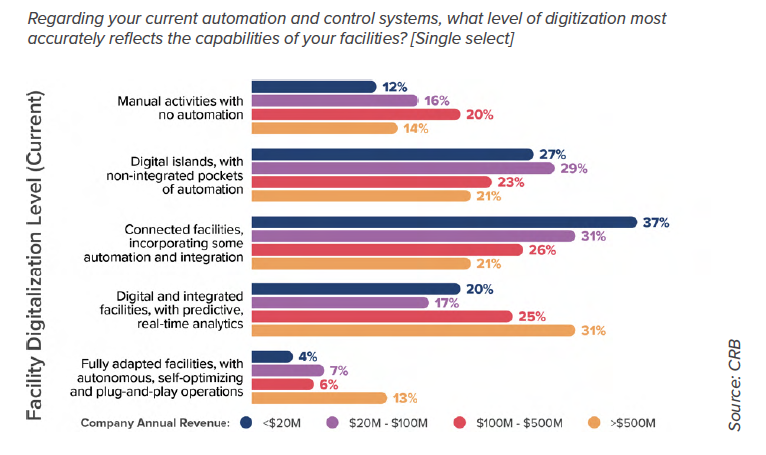

Currently, a large majority of manufacturers have some level of automation, ranging from “digital islands” (i.e., non-integrated pockets of automation) to fully adapted facilities, with autonomous, self-optimizing, and plug-and-play operations, while 40% plan to increase their level of automation over the next two years.

Almost all manufacturers either currently use (60%) or plan to adopt artificial intelligence (32%) as a way of improving operational efficiency. The most common applications are quality testing, to optimize manufacturing, and to improve material planning. “Only 8% said no to AI,” Moses noted. “And that’s really surprising given the distribution of respondents where a quarter were coming from smaller companies….[AI] has really just permeated the industry. I think it can be a competitive advantage, especially with all the business as well as innovation pressures.”

These are just some of the highlights from Horizon: Pet Food. Download the full report for more insights into where the industry is going and how it plans to get there.