The data below was collected from a survey of U.S.-based consumers for our 2025 Consumer Food Trends Report. Download the report for more insights and strategic recommendations.

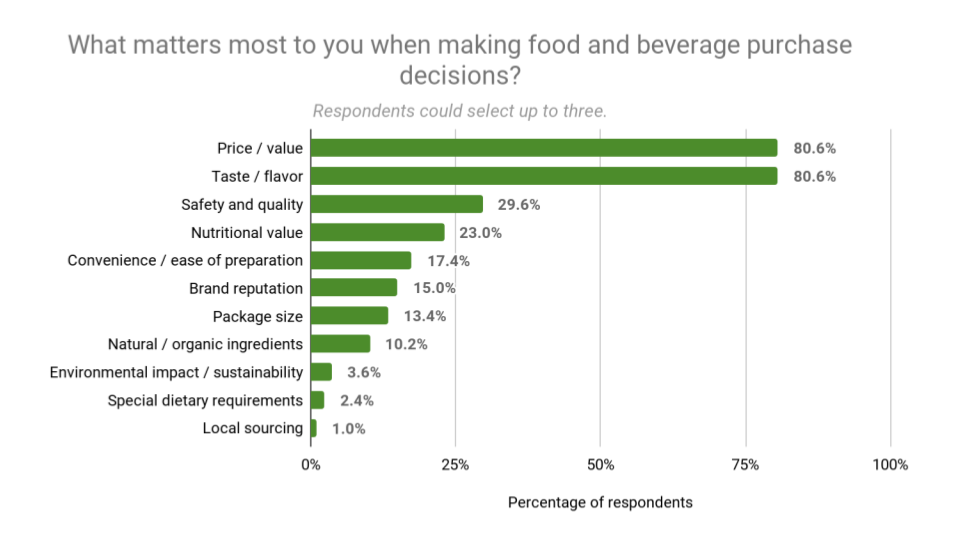

While price and taste continue to be the biggest influencers of consumer food and beverage purchases by far — more than 80% of consumers say these factors matter most to them — younger generations may be ushering in shifting priorities. Our 2025 Consumer Food Trends Report found that Gen Z is more likely than the general population to prioritize things like brand reputation (25% compared to 15%) and natural / organic ingredients (16% compared to 10%).

Here’s a look at some of the highlights from our report, including key purchasing drivers, product discovery channels, and shopping preferences.

Quality and nutrition contribute to decision-making

Aside from price and taste, three in 10 survey respondents overall say safety and quality is a primary influencer of their buying decisions, while 23% consider nutritional value important. Our survey found that higher income consumers are even more likely to value nutrition (29%), as well as factors like natural / organic ingredients (17%) and sustainability (8%).

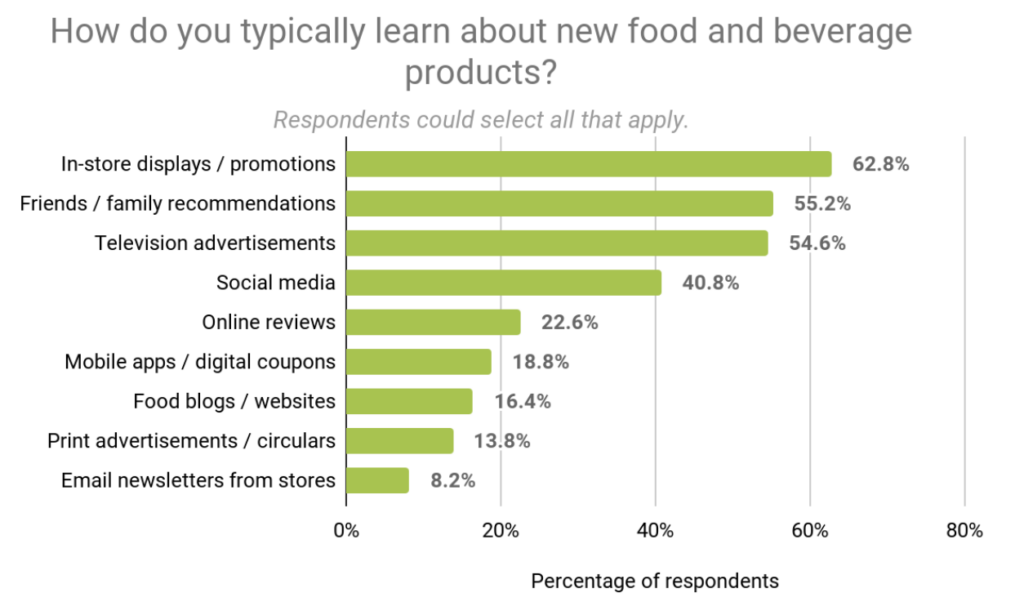

Different generations, different discovery channels

While the majority of consumers in general learn about new products via in-store promotions and displays (63%), product discovery channels vary greatly by generation.

For example, while television ads are the most effective discovery method for Gen X (64%) and 20% of respondents aged 60 and older still rely on print advertisements and circulars, Gen Z (75%) and Millennial consumers (64%) are much more likely to find out about new products through social media.

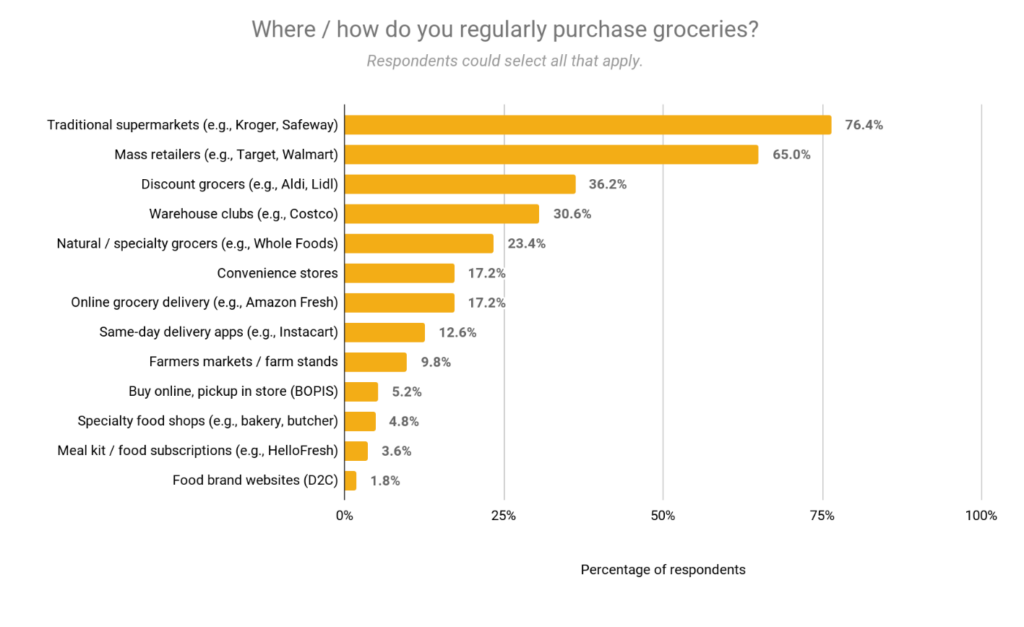

Traditional supermarkets reign, but specialty and online stores are growing

Traditional supermarkets aren’t going anywhere — 76% of respondents regularly buy groceries at places like Kroger and Safeway, while 65% often buy groceries from mass retailers.

However, Gen Z is more likely to shop elsewhere, with top destinations including natural / specialty stores (47%), warehouse clubs (47%), and convenience stores (34%). Many are regular users of online grocery delivery (28%) and same-day delivery apps (25%). Millennials (31%) and parents (29%) are also strong users of online grocery delivery, showing a preference for the convenience of buying online.

However, Gen Z is more likely to shop elsewhere, with top destinations including natural / specialty stores (47%), warehouse clubs (47%), and convenience stores (34%). Many are regular users of online grocery delivery (28%) and same-day delivery apps (25%). Millennials (31%) and parents (29%) are also strong users of online grocery delivery, showing a preference for the convenience of buying online.

Uncover more consumer insights

Understanding shifting consumer preferences and shopping habits is crucial for staying ahead in a competitive marketplace. Aligning product offerings and marketing strategies with these trends can be the key to winning consumer loyalty and driving sales.

To help industry leaders identify key trends, purchasing drivers, and strategies for success, we asked U.S.-based consumers to share their shopping habits, dietary needs and preferences, and thoughts on issues like food safety and sustainability. You can find their responses, along with actionable recommendations, in our 2025 Consumer Food Trends Report.

![[Report] 2025 Consumer Food Trends](https://foodindustryexecutive.com/wp-content/uploads/2025/01/2025-Consumer-Trends-Report_-From-Price-to-Purpose-218x150.jpg)