On April 15, we published an article speculating about whether the plant-based food trend would survive COVID-19. At that time, meat sales had been spiking and a few analysts had predicted that shopping during the pandemic would focus on core, familiar products, rather than new flavors and cuisines, which is a top reason people purchase plant-based foods.

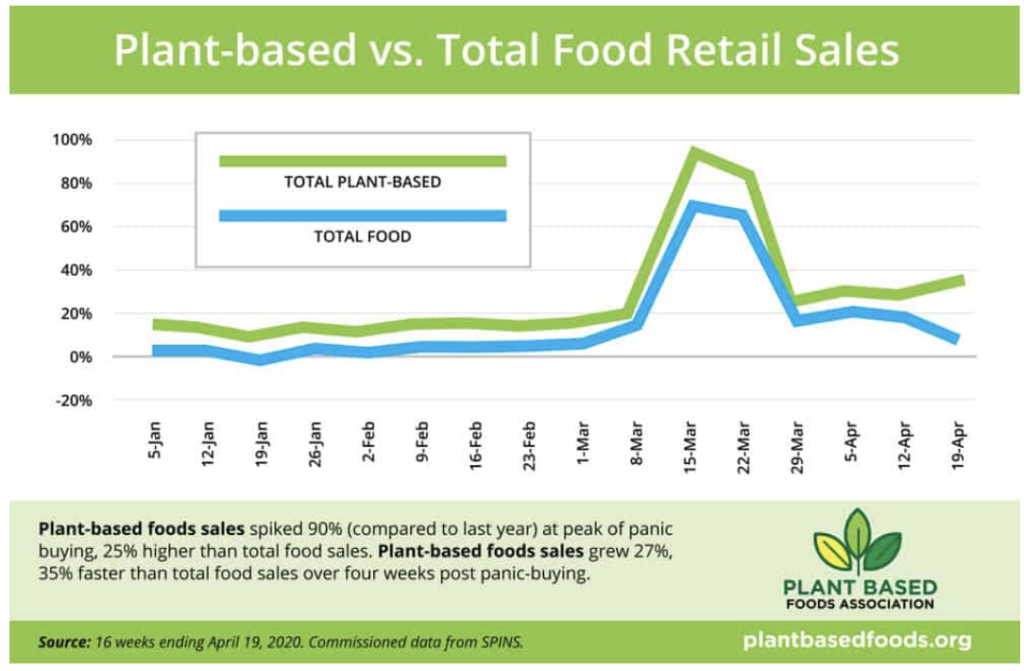

Well, the results are in, and they show that the predictions were premature. New data from the Plant Based Foods Association (PBFA) and SPINS show that, both during and after the weeks of peak panic-buying that occurred in March, plant-based food sales soared, with their growth outpacing total food sales.

Here are the highlights:

- In mid-March (peak), sales of plant-based foods were up 90% year-over-year. For the 4 weeks following, plant-based food sales at retail grew 35% faster than total retail food sales.

- At peak, plant-based meat retail sales were up 148% from last year, continuing to grow at a rate of 61% for the 4 weeks following.

- Plant-based cheese retail sales hit 95% YoY at peak, growing at 54% for the 4 weeks after.

- Tofu and tempeh retail sales saw their spike at 88% YoY and continued to grow at 35% for the next four weeks.

Julie Emmett, senior director of retail partnerships at PBFA commented: “This new data shows that consumers are turning to plant-based food options now more than ever. Even after the highest panic-buying period, plant-based foods growth remains strong, proving that this industry has staying power.”

These growth numbers, while impressive, need to be put into perspective. The market share for plant-based foods is still very small.

For a recent article in The Analogue Dish, the only business publication exclusively dedicated to the plant-based meat substitute and cultivated meat industries, Anne-Marie Roerink of 210 Analytics LLC analyzed IRI data for meat and meat alternatives. She found that, between March 8 and May 10, plant-based meat alternatives saw 86% dollar growth, representing an absolute gain of $100.3 million. At the same time, the meat department had just 45.2% dollar growth, but the absolute gain was $5 billion. Because of the disparities in market size, the market share for plant-based alternatives actually declined, from 1.5% for the week ending March 1 to 1.27% for the week ending May 10.