“Far from abandoning their natural lifestyle during COVID-19, natural products shoppers are widening their preferences, seeking and avoiding various ingredients, label claims and certifications,” states COVID-19 and Navigating the Path Ahead: Supporting The Natural Products Consumer, a report from SPINS and IRI.

This finding is in line with a mid-April Ecovia report and the 2020 Q1 Organic Produce Performance Report from the Organic Produce Network. Both found organic food sales were getting a boost from COVID-19, as consumers looked to adopt healthier habits.

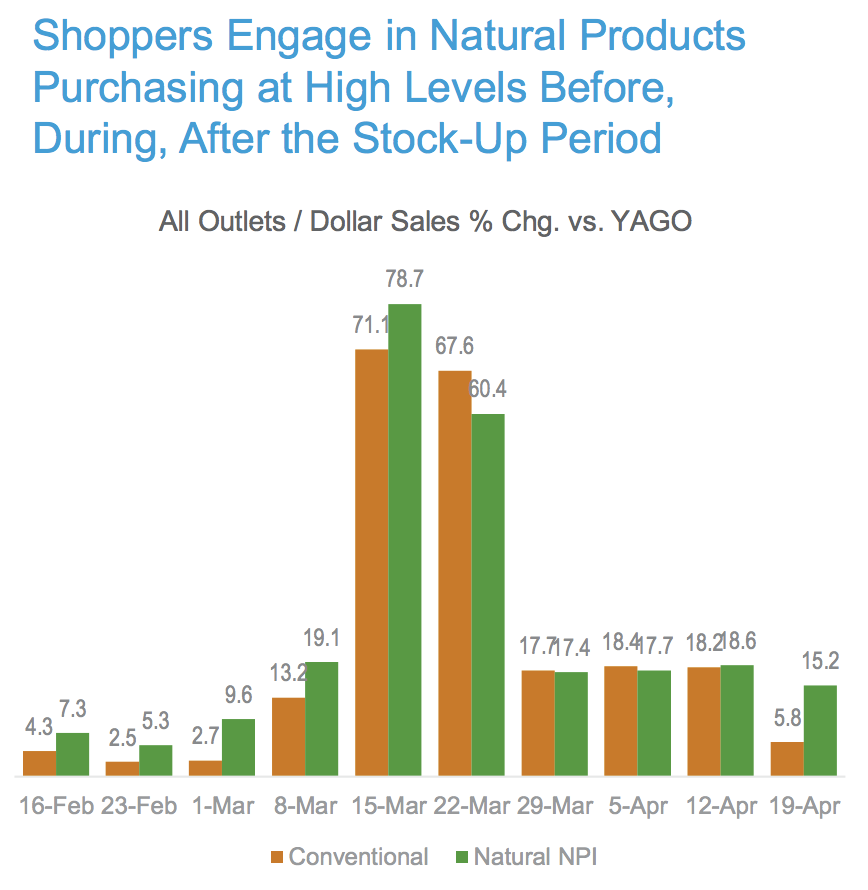

SPINS/IRI data show sales of natural products generally grew faster than conventional sales before and during peak pandemic stock-up. Sales growth has continued strong since the peak, as shown in the following chart:

Source: COVID-19 and Navigating the Path Ahead: Supporting The Natural Products Consumer

Source: COVID-19 and Navigating the Path Ahead: Supporting The Natural Products Consumer

In addition to consumers who preferred natural products before COVID-19, health concerns created by the pandemic have prompted new shoppers to buy natural products. This shift has created an opportunity for retailers and manufacturers to show support, promote offerings, and retain these new shoppers as loyal natural products shoppers, according to the SPINS/IRI report.

An important shift in natural product sales has been to more online sales — from about 3% of dollars spent per buyer in late January to about 15% in late April. For the month after peak stock-up, online sales continued to have double-digit growth, while other channels experienced less growth.

What does the future hold?

Economic pressures and product availability will affect how consumers buy, states the SPINS/IRI report. Shoppers will make choices based on their available budgets by seeking out sale items, larger sizes, private label products, and perhaps different product attributes.

To retain loyal but economically challenged consumers, SPINS/IRI suggests retailers can use private label and pricing strategies. Retailers can learn from previous recession buying behavior. During the 2008 recession, dollar sales of organic private label products grew 49% compared to 8% for branded counterparts.

SPINS/IRI believes “overall natural foods growth will continue but engaged natural shopper behavior will likely follow 2008 trends.”

Success strategies for natural brands

Based on lessons from past recessions and recent emerging trends, the SPINS/IRI report suggests a three-point road map for success:

- Understand how your customer engages with natural foods. Develop strategies to encourage core natural shoppers to maintain and increase their buying. Focus on value strategies to retain less engaged shoppers.

- Identify your brand’s new buyers and their behaviors, develop conversion strategies, and actively use targeted marketing and communications to engage new buyers. Leverage lifestyle and ingredient-based product attributes and customer segmentation to effectively navigate the underlying dynamics of today’s natural marketplace, identify emerging trends, and build personalized conversations.

- Develop and refine an adaptable channel strategy to support the new normal. Design effective sales strategies for both physical locations and online sales. Give consumers the detailed product information and transparency they desire. Use pricing and promotion analytics to determined the best pricing and promotions for each sales channel. Price appropriately to meet future needs.