Total 2019 sales for the specialty food market was $158.4 billion, a 10.7% increase since 2017, according to the new State of the Specialty Food Industry report from the Specialty Food Association (SFA). Brick-and-mortar retail accounted for 75% ($118 billion) of the sales. However, over the last few years other channels — foodservice and the online specialty channel — have driven growth of specialty food sales.

Mainstream supermarkets made 83% of all sales. But natural food supermarkets grew faster than the other channels in the last couple of years, even with consolidation caused by the closing of some stores as they faced increased competition from mainstream stores.

Over the three years through 2019, specialty food sales grew about 9%, about three times faster than all food and beverage. Over the last decade, specialty products have generally grown three times faster than the entire food and beverage market.

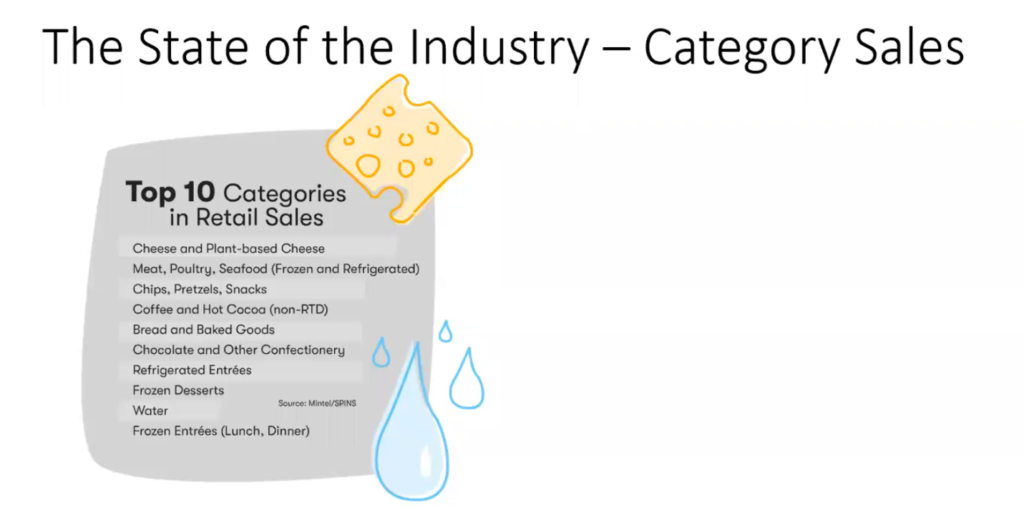

The following graphic shows the top 10 categories overall by 2019 retail sales. Although this list has been mostly stable in recent years, the big change is that yogurt fell out of the top 10.

Source for all images: The State of the Specialty Food Industry + COVID-19 Impact Webinar

Source for all images: The State of the Specialty Food Industry + COVID-19 Impact Webinar

COVID-19 intervenes

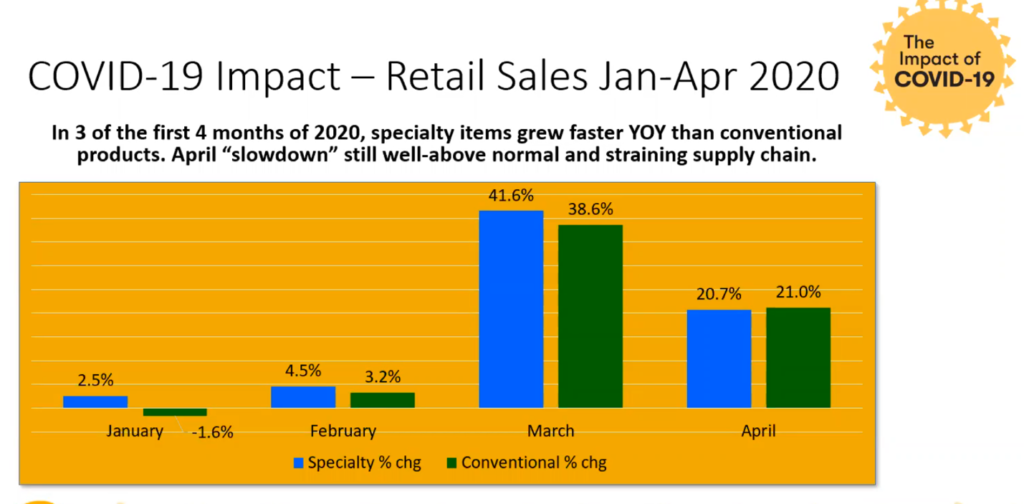

Panic buying has affected specialty food as much as it has conventional food, according to The State of the Specialty Food Industry + COVID-19 Impact Webinar. The following chart shows year-over-year growth in both sectors for January through April.

Not shown on the chart: The growth rate for specialty food in May was just over 10% and in June, just below 10%.

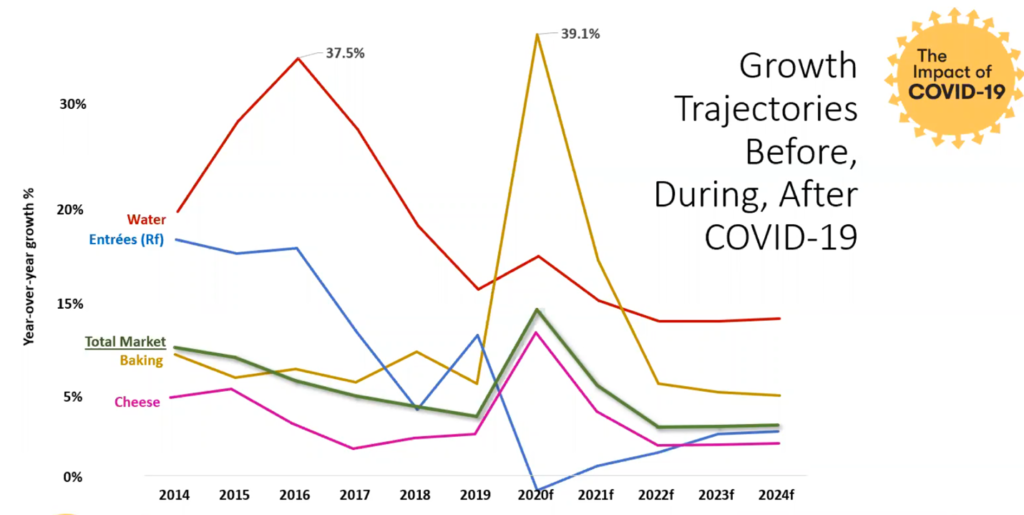

The following chart shows historical and projected growth rates for categories within specialty food.

The specialty food consumer

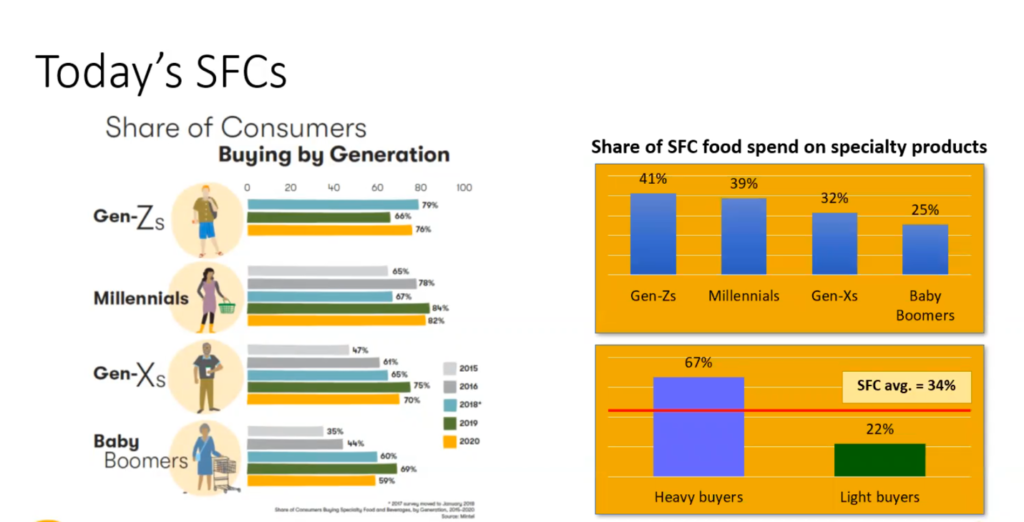

Millennials are the most likely to buy specialty foods and are the anchor point for the industry now that they’re having families. Gen Z is also important and was the only generation where buyers increased, while baby boomer buyers decreased slightly. Gen Z spends more of their food budget on specialty foods than other generations, although the total spent is not nearly as much as millennials. Heavy buyers, who make up 29% of the specialty food population, spend 67% of their budget on specialty foods.

Where do specialty food consumers shop?

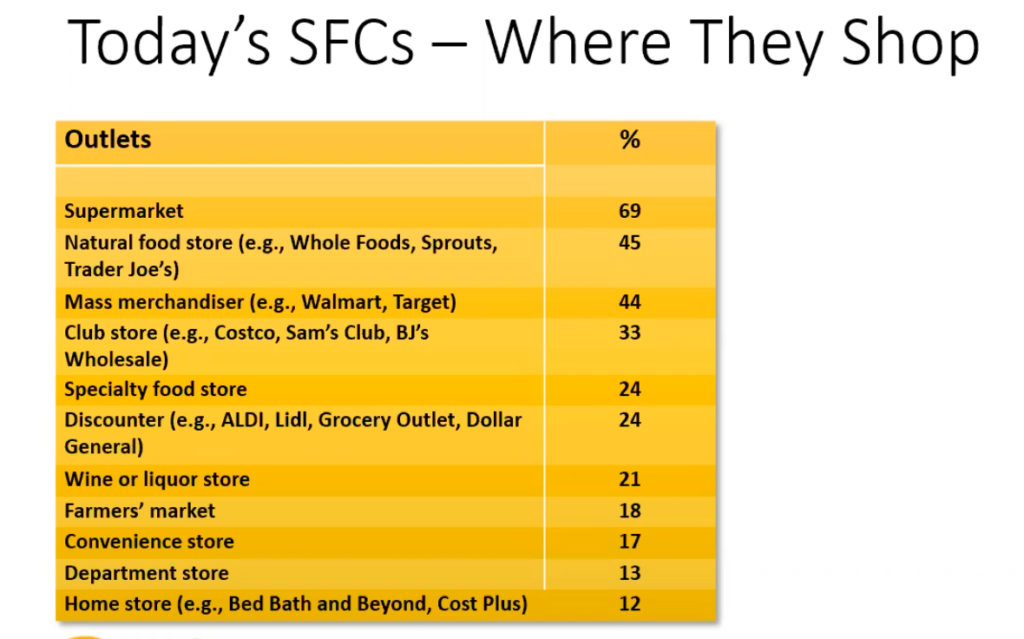

Specialty food buyers shop in a lot more channels than do conventional shoppers. The biggest trend in the last several years is supermarkets and mass merchandisers investing heavily into specialty foods because they’ve seen specialty foods grow substantially faster than conventional every year. The following chart breaks down where specialty food consumers shop.

SFA’s report is based on a survey from January. Using data from other providers and market research firms, SFA believes lighter buyers are likely buying fewer specialty foods now because they can’t afford these products or possibly because they are frequenting stores where specialty food products are not readily available. But SFA believes the core consumer is going to remain committed, although all specialty food consumers will focus more on value in the next year due to economic concerns.

Where is the specialty foods industry headed?

SFA expects 13.3% growth for the specialty food market for 2020. In January through April, specialty foods rose 17.3%, but SFA believes the rest of the year will slow down month by month.

SFA expects grocery sales to remain above average through 2020 and 2021 and for the growth in online sales to continue. Fresh perimeter departments are going to slowly reopen and recover. There will be category winners and losers, meaning retailers need to be aware of category performance. Plus, an economic downturn could mean conventional product growth will outpace specialty growth by the end of this year, which would be a first.