In 2019 the U.S. and Canadian food and beverage industry closed 276 mergers and acquisitions, according to Duff & Phelps, a multinational financial consultancy that publishes quarterly Food and Beverage M&A Landscape reports. The firm’s Fall 2020 report reveals 209 closed deals for the first three quarters of 2020: 82 in Q1, 56 in Q2, and 71 in Q3.

In Q2 many buyers shifted their focus away from M&A and other strategic initiatives due to COVID-19, note the Summer and Fall reports. However, reduced uncertainty in Q3 led to more food and beverage M&As than occurred in Q3 of 2019. “Businesses and consumers have adapted to ‘the new normal,’ and credit markets have recalibrated to allow access to capital for acquisitions,” states the Fall report.

Duff & Phelps expects more M&A activity to occur in Q4, stating strategic buyers have ample cash and private equity funds have access to stable financing again and need to place capital. Also, Special Purpose Acquisition Companies (SPACs) are becoming “a new vehicle for investors to create value in the food and beverage space.”

Consulting firm PwC agrees, also saying, “The M&A recovery that began in the second half of 2020 will accelerate in 2021, as corporate and private investors have access to capital and can pursue deals to build scale and expand scope.”

PwC believes investors want to strengthen core operations, build operational efficiencies, and expand digital capabilities to build resilience and emerge stronger in the new normal of COVID. Attractive high-growth food categories include snacks, frozen foods, plant-based products, and better-for-you products.

As for who drives M&A activity in the food and beverage sector, it is strategic buyers (including companies mostly owned by private equity investors), according to Duff & Phelps. For the 12 months ending September 30, 2020, strategic transactions accounted for 83% of total deal value.

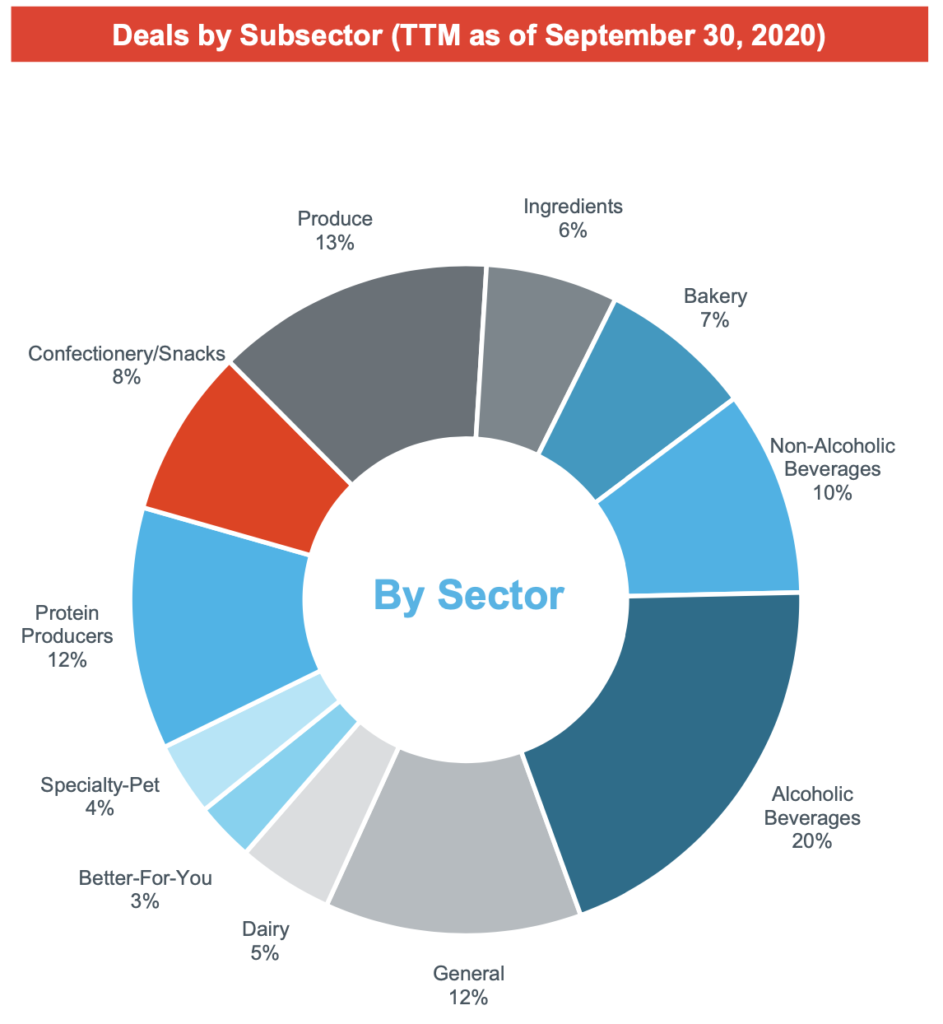

North American M&A Activity by Subsector For 12 Months Ending September 30, 2020

Source: Food and Beverage M&A Landscape, Fall Report, Duff & Phelps

Sampling of Deals Announced in Q4 2020

| Buyer | Acquired | Deal Announced |

| GrubMarket | Best Fresh Produce | October 22 |

| The Fillo Factory | GeeFree | October 28 |

| Nestlé USA | Freshly | October 30 |

| Ingredion, Inc. | Verdient Foods Inc | November 1 |

| Kerry Group | Bio-K+ International Inc. | November 4 |

| Crave Better Foods, LLC | Solero Organic Fruit Bars | November 10 |

| Utz | On The Border | November 12 |

| Mars, Inc. | Kind Healthy Snacks | November 17 |

| Ahold Delhaize and Centerbridge Partners | FreshDirect | November 18 |

| HelloFresh | Factor75 | November 23 |

| McCormick | Cholula Hot Sauce | November 24 |

| B&G Foods, Inc. | Crisco brand of oils and shortening from The J. M. Smucker Co. | December 1 |

| Kind Healthy Snacks | Nature’s Bakery | December 2 |

| Post Holdings | Peter Pan Peanut Butter from Conagra | December 7 |

| TreeHouse Foods | Riviana Foods U.S. branded pasta business | December 11 |

| Michael Foods, a subsidiary of Post Holdings, Inc. | Almark Foods | December 14 |

| Whole Earth Brands, Inc. | Wholesome Sweetener | December 17 |

| Egg Innovations, Inc. | Peckish | December 17 |