Globally in 2020, agriculture and food (agrifoodtech) startup companies raised $26.1 billion, according to the 2021 AgriFoodTech Investment Report from AgFunder. That’s a 15.5% year-over-year (YoY) increase. The company expects the amount to increase to more than $30 billion as unannounced 2020 deals are revealed, which would amount to growth of 34.5% over 2019.

Making up much of the increased investment from 2019 to 2020 was late-stage deals, with “investors doubling down on their existing portfolio and the first-wave of agrifoodtech innovations.” The median deal size for growth rounds increased 29% from 2019. Late-stage rounds were up 17%.

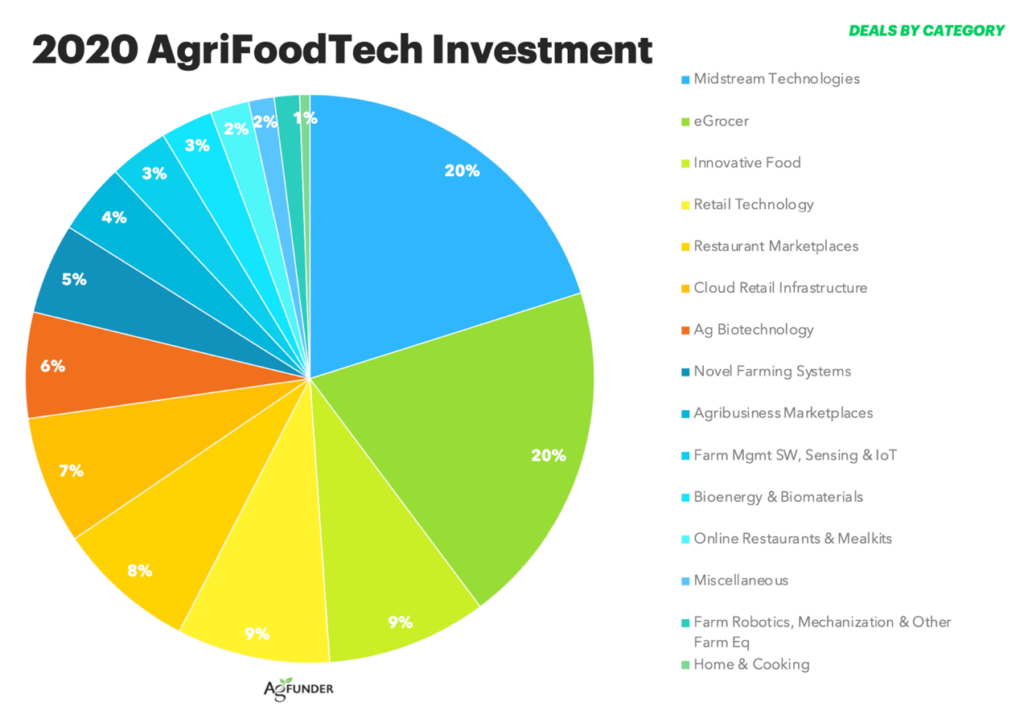

Also up were early-stage deals for upstream startups (those closer to the farm) — ag biotech, farm management software, farm robotics & equipment, bioenergy & biomaterials, novel farming, agribusiness marketplaces, midstream technologies, and innovative food. They closed 30% more deals and received almost 50% more dollars YoY.

Overall, upstream investment was higher than downstream investment for the first time in seven years, partly because many upstream food production categories had COVID-19-related appeal. They received $15.8 billion in 1,950 deals, up 68% from 2019. Categories seeing a large increase in investment were midstream technologies, with a focus on efficient supply chains and innovative food, driven by alt protein startups.

Downstream companies (startups closer to the consumer) — in-store restaurant & retail, online restaurants & meal kits, eGrocery, restaurant marketplaces, and home & cooking — received $14.3 billion in 1,142 deals. eGrocery startups raised $5.1 billion. However, overall early-stage downstream investment decreased, with a 15% drop in retail & restaurant and an almost 50% decline in home & cooking tech.

AgFunder believes now is the time to invest in agrifoodtech, noting the COVID-19 pandemic “has highlighted the importance of efficient supply chains and alternative ways of growing, processing, transporting, and selling food to consumers.”

Source: AgriFoodTech Investment Report

U.S. agrifoodtech

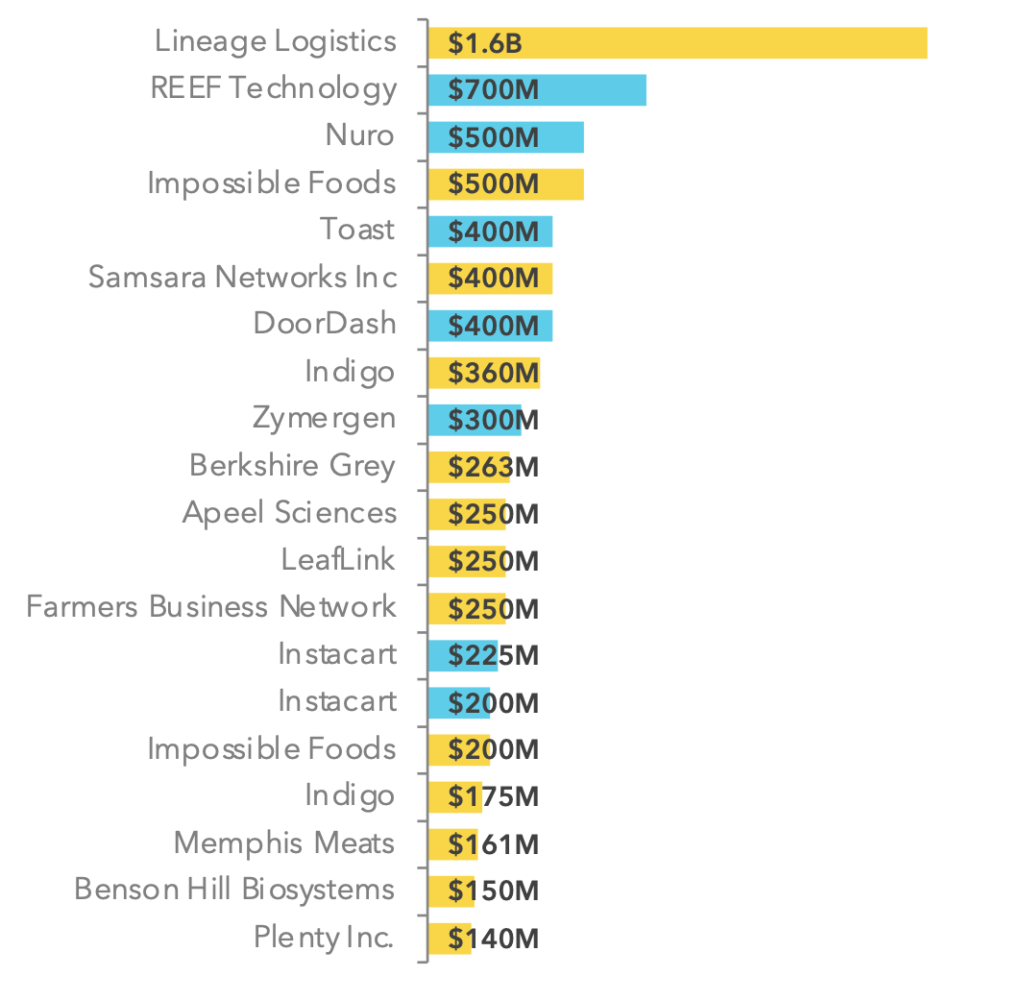

Agrifoodtech startups in the United States raised $15.45 billion in 2020 — 37% of deals and 51% of committed dollars. The number of U.S. deals increased 30% YoY. This increase reversed a previous declining trend. “The return of capital to the US could be a slight flight to safety in the wake of the pandemic, as well as investors doubling down on previous and now more mature bets in their portfolios,” states the report.

Here’s the list of top U.S. deals

Source: AgriFoodTech Investment Report — Yellow indicates upstream deals and blue indicates downstream deals.

2021 predictions

AgFunder makes the following predictions for 2021:

- The trend for early-stage businesses to go public using Special Purpose Acquisition Companies (SPACs) will continue.

- eGrocery will continue to change traditional retail. The primary way consumers discover new products will move from store shelves to phones. The power of traditional brands will decrease as consumers discover and choose smaller startup brands.

- As plant-based products become more mainstream and price-competitive, animal agriculture will move more towards regenerative practices, carbon neutrality, and premium offerings. Dairy will remain strong as farms work towards carbon neutrality.