Ocean freight costs will soften but remain elevated compared to pre-pandemic levels due to structural factors. In a recent report, Rabobank outlines some actions food & agribusiness companies can take to address these circumstances.

Challenging freight conditions will remain

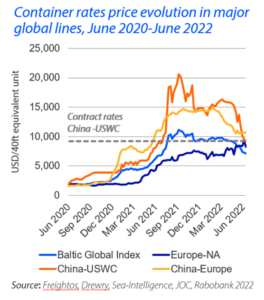

In the last two years, high ocean rates reached new records, led by east to west routes. Although spot rates have recovered from the irrational levels of Q4 2021, they still remain three to five times above pre-2020 levels. Contract rates have also risen significantly and remain elevated.

Schedule reliability dropped from 70% to the 30% range, as disruptions and uncertainties cascaded across the globe. Rabobank expects schedule reliability to recover, but slowly. Congestions are expected to remain at key ports until 1H 2023.

“Port congestion is a major contributor. While various processes have been implemented to improve efficiency, structural factors – including a lack of coordination between ocean and hinterland transport, labor shortages with uncertain union negotiation outcomes, disrupted trade flows, and a general lack of automation continue to pose a threat to port operations and growth,” explains Xinnan Li, Analyst – F&A Supply Chains at Rabobank.

Consolidation and strategic alliances led to historic profits

Record rates were achieved because of the effective horizontal cooperation among ocean carriers, following decades of consolidation and alliances. This brought enormous financial benefits to the traditionally thin-margined sector. “A significant amount of profit has been reinvested into expanding ship fleets and container capacity, with a 17.6% capacity increase coming online in 2023 and 2024. However, we do not expect rates to return to pre-pandemic levels,” says Li.

Carriers are now efficiently adjusting supply according to demand by taking ships on- or offline. Carriers are expected to continue to prioritize margins over individual market share through the possible economic downturn.

Macro drivers are influencing shipping dynamics

Several global macro drivers are behind the shipping chaos and explain the lingering high costs.

- Increased consumer demand coupled with depleted inventories will extend demand for ocean freight through 2022. However, record-low consumer confidence and a probable recession might mean a relief in ocean freight rates.

- Dry and reefer containers are held out of circulation due to imbalanced global trade flows. Port congestion and difficulties in returning empty containers have further reduced container capacity, disrupting the flow of goods and artificially inflating container rates.

- Geopolitical uncertainties have a large impact on the global shipping industry, increasing risks and price volatility. Sanctions against Russia held up ships and containers at various ports globally; the US government is gradually scrutinizing the ocean shipping sector; and dependence on China has increased to a record level both from an export volume and a ship manufacturing perspective.

- Operational costs will continue increasing due to high energy costs in the medium term and sustainability-related regulation changes, such as a carbon tax, in the long term.

What can F&A companies do in these challenging conditions?

According to Viet Nguyen, Analyst – F&A Supply Chains at Rabobank, strategic partnerships and long-term contracts can be key to ensuring service reliability for shippers and minimizing disruptions to their supply chains. Other strategies include supply chain reconfiguration such as expanding sourcing to new regions, sourcing closer to home, or ‘friend-shoring’ – sourcing from politically-aligned regions.

Given the uncertainties in ocean freight and the risk of supply chain disruptions, F&A companies are increasingly taking outsourced logistics operations back in-house. “This allows for better control of the supply chains and shorter lead times, but this usually only addresses one of the bottlenecks in the chain and may incur increased costs,” points out Nguyen.