Six in ten (61%) consumers say they won’t buy products from companies with poor environmental practices, and 38% have actively boycotted food brands for this reason, according to a new report from ING: Learning from Consumers: How Shifting Demands Are Shaping Companies’ Circular Economy Transition.

For the third installment of their annual sustainability report, the banking and financial services giant surveyed 15,000 global consumers to uncover their attitudes and actions related to corporate sustainability practices. We spoke with Anne van Riel, ING’s head of sustainable finance, about the results.

Environmental impact is more important than brand name

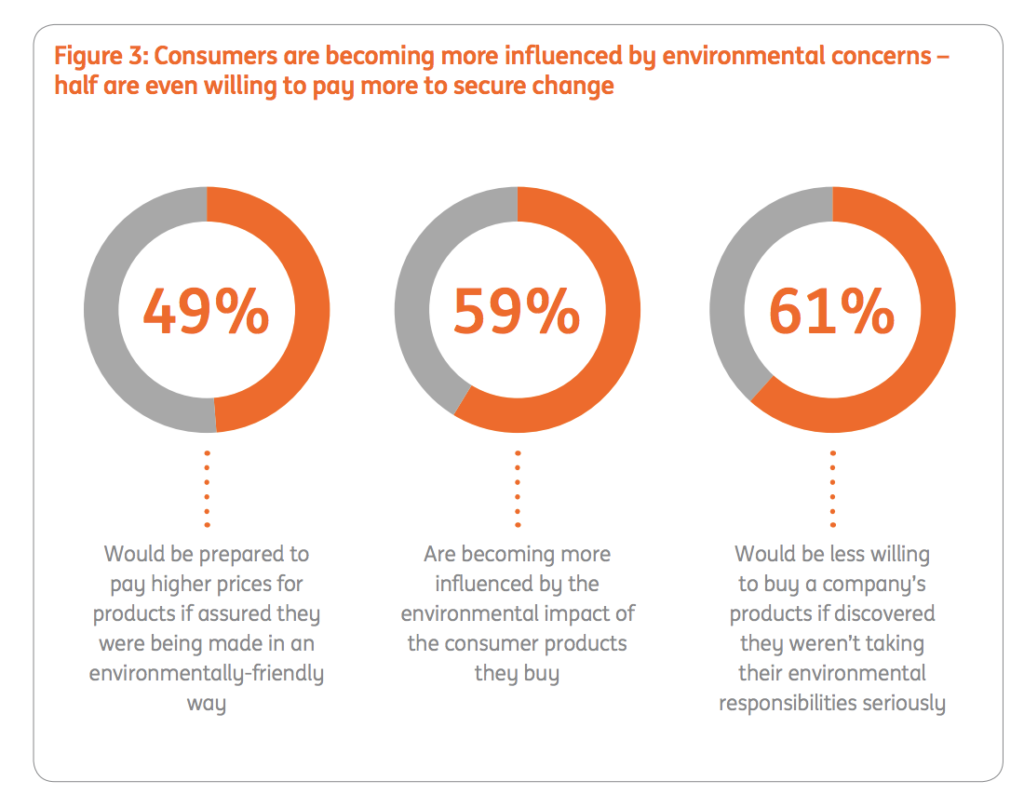

Several studies have shown the growing importance of environmental impact, and ING’s survey affirmed the previous findings, including that consumers are willing to pay more for environmentally-friendly products.

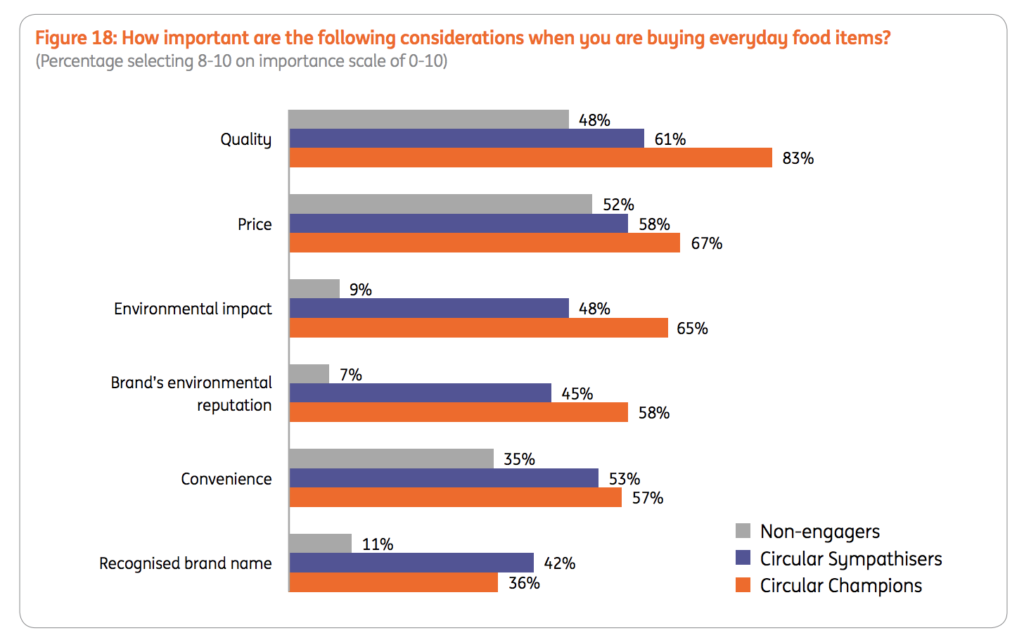

One of the new findings is that environmental impact has become a significant factor influencing purchase decisions — even more significant than brand name. “The biggest thing that we’ve found is that increasingly buyers are looking at the environmental impact of a product and factoring that into their buying decisions,” van Riel says.

Nearly four in ten (37%) of consumers said environmental impact influences the purchase decision. “That’s a striking result,” van Riel says. “And it’s mostly driven by younger consumers. We also have data that says that of the younger population, almost half (48%) have boycotted a food or decided not to buy it because of the environmental impact.”

Convenience is also a driving factor, and Van Riel suggests that the need to provide products that are both environmentally friendly and convenient could drive industry change. “If you make [purchasing environmentally friendly products] very convenient and very transparent, then people will make the right decision, if you will,” she says. “But it becomes harder to convince more people if it’s still inconvenient to make the right decision. You see innovations in other industries already. The food industry will have to adapt as well.”

3 types of consumers represent expanded opportunities

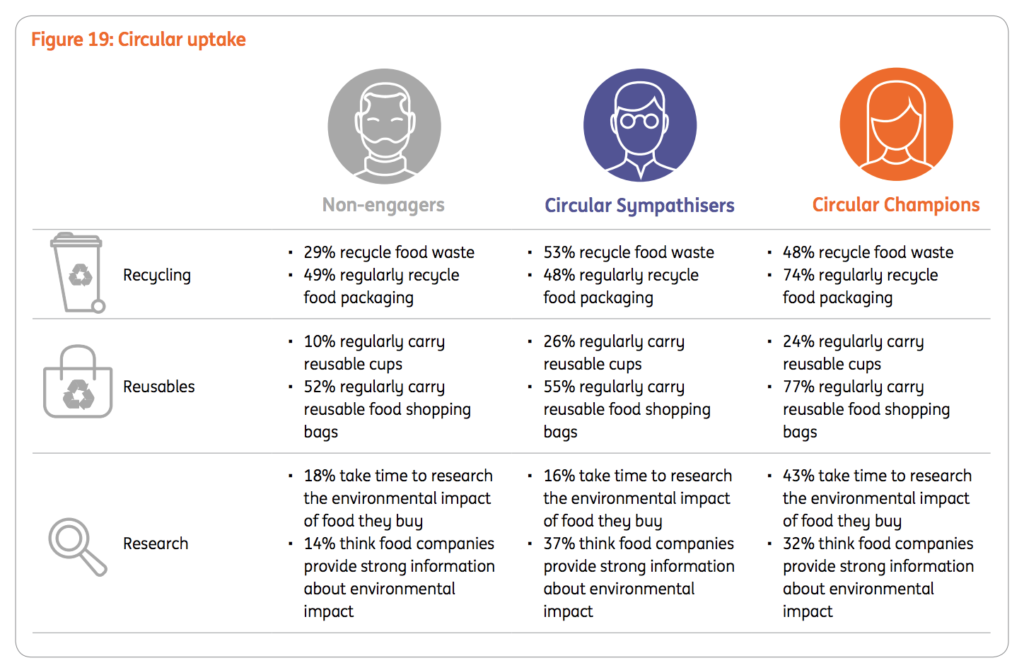

ING divided survey respondents into three groups based on their attitudes toward sustainability and willingness to change their behaviors.

- Circular Champions (28%) — For these consumers, sustainability is critical. They’re willing to pay more and put in more time and effort to support sustainability (e.g., actively recycle).

- Circular Sympathizers (30%) — These consumers care about sustainability and would be willing to pay more, but they’re not willing to inconvenience themselves.

- Non-engagers (42%) — These consumers don’t consider sustainability in their purchasing decisions, they won’t pay higher prices, and they’re skeptical that their individual actions can have an impact.

These groups have different priorities when making food purchase decisions and different rates of participation in the circular economy.

Van Riel suggests that companies can succeed by targeting all of these consumers. “To really make an impact, you have to target not only Circular Champions, but also the other two groups,” van Riel says.

For example, Non-engagers are more driven by price, quality, and convenience than by environmental impact. Van Riel suggests that this group can be moved in the direction of sustainability by making sustainable products that meet their three core values. “If you can make [a product] convenient and reasonably priced, then you will have a [much] bigger market for it. Don’t try to convince them of a different narrative. Just make it as easy as possible [for them to act sustainably].”

Going forward, sustainability will no longer be optional

Just about every report we’ve covered has shown that young consumers are more sustainably minded than older ones. ING’s does as well. “Non-engagers are typically older consumers that have always done certain things and don’t necessarily believe they have an impact,” van Riel explains. “Younger consumers do believe they can have an impact and they look at what they’re spending and think they could do a better job.”

This means that environmental impact will only grow in importance, and companies that haven’t started thinking about this now could face trouble in the future. “If you stay behind and don’t make clear what your policies and practices are, people will slowly start to move away from you and [toward] companies that [are transparent about] where the product is made, how it’s made, and what the environmental impact is,” van Riel says.