Transparency is important or extremely important to 81% of shoppers both online and in store, according to Transparency Trends: Omnichannel Grocery Shopping from the Consumer Perspective, a report from FMI and Label Insights. That’s up from 69% in 2018. The new follow-up report delves deeper into shopper’s transparency behaviors and expectations for in-store and online shopping.

How do shoppers define transparency? The research found they look for the following information from a brand or manufacturer:

- Complete list of ingredients (62%)

- Description of ingredients in plain English (53%)

- Certifications, such as USDA organic (48%)

- In-depth nutritional information (47%)

- Details about sourcing (38%)

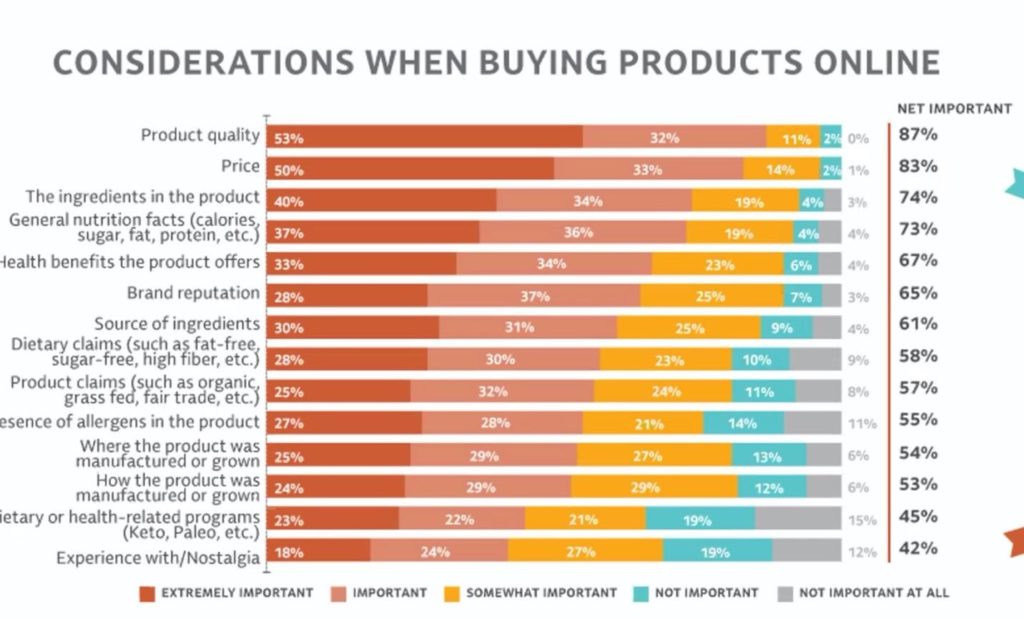

In addition, some shoppers look for information about allergens or product claims such as heart healthy, according to a July 30 webinar discussing the report. A small, but vocal, minority (up from 20% in 2018 to 29% in 2020) look for sustainability information. This includes details about how the product is produced and value-based information such as animal welfare and fair labor practices. The following chart looks specifically at what shoppers consider when online shopping.

Source: FMI Webinar

Source: FMI Webinar

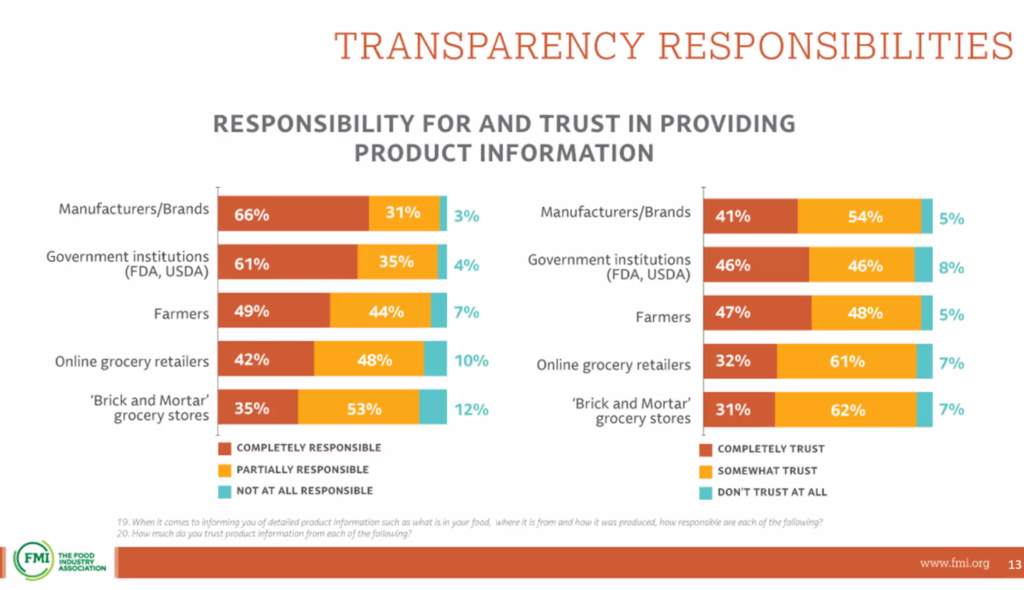

Who do shoppers believe is responsible for transparency information? Manufacturers, brands, and government institutions have full responsibility, say 61% of shoppers. But there’s a trust problem — only 41% of shoppers completely trust manufacturers and brands and only 46% trust government institutions to provide accurate information.

When it comes to grocery retailers, shoppers have higher transparency expectations for online shopping, with 42% expecting online grocery retailers to provide detailed product information. Only 35% of shoppers think physical grocers have that responsibility.

However, shoppers will also go online for more information when they need more product details or answers to questions. When confused about ingredients, 47% of shoppers conduct online research and 89% say they would more likely look for product details if more information were available online. Notably, 27% of shoppers just switch to an alternative product if they don’t understand the ingredients, while 23% accept not understanding and buy the product anyway.

Source: FMI Webinar

Source: FMI Webinar

Changing consumer eating habits are also affecting transparency needs. In 2020 more shoppers (64%) follow a diet or health-related eating program than in 2018 (49%). Also of more concern now are food allergies, intolerances, and sensitivities — for 55% of shoppers in 2020 compared to 44% in 2018. These people look for trusted information about food products to make sure they fit into a particular diet or don’t contain particular allergens.

“As consumers continue to take more responsibility and effort to eat healthier, retailers and brands have the opportunity to be one of those trusted advisors,” said Doug Baker, FMI Vice President, Industry Relations, during the webinar.

Baker also pointed out that the increased consumer focus on health and safety, along with more focus on environmental and social issues, means brands and retailers need to consider a strategy that increases their transparency, communication, and engagement with these consumer-related topics.