“The definition of sustainability is evolving, with more and more emphasis on health and nutrition, and sustainability as it relates to an individual, instead of the more traditional associations of sustainability and its impact on the environment,” according to Sustainability in Motion, a new report from Kerry.

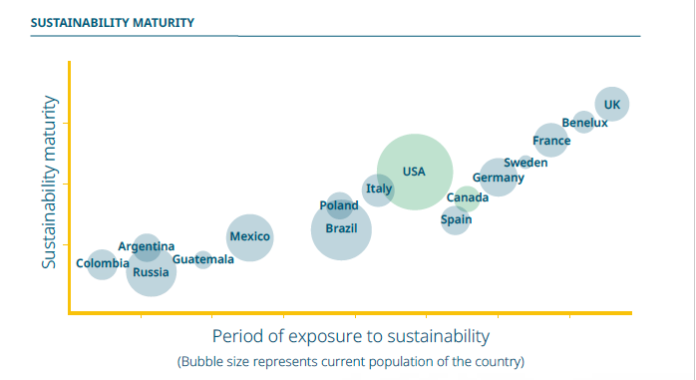

In a survey of over 14,000 consumers in 18 countries, Kerry found 49% of consumers think about sustainability when choosing food and beverages and about 75% expect companies to invest in sustainability. While U.S. consumers are ahead of some countries in demanding sustainability, they fall behind consumers in many European countries.

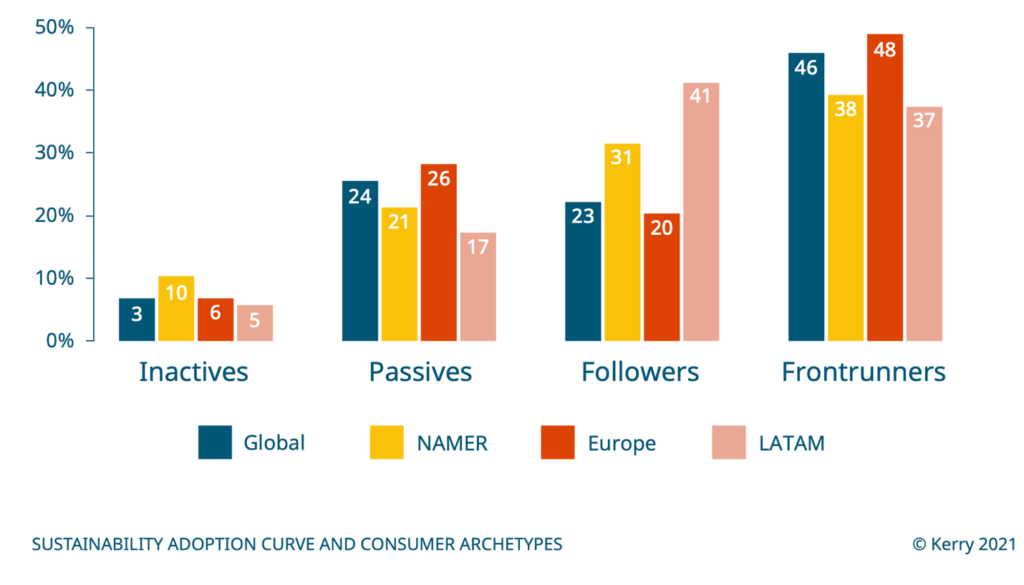

A consistent sustainability adoption curve exists. Kerry identifies four sustainability-minded consumer archetypes who are at different points on the curve:

- Inactives (6%) care a little but don’t act. Price is a big barrier. Kerry notes this group also represents the 51% of the global population who do not yet consider sustainability in choosing food and beverages.

- Passives (24%) have deep environmental concerns but don’t understand their role/impact on sustainability. Price is a barrier. Passives are more likely to be women and boomers.

- Followers (23%) are more likely to be younger millennials and Gen Z. They are engaged and willing to act but want manufacturers, brands, or external authorities to take the lead.

- Frontrunners (46%) are more likely to be older millennials. They are deeply engaged, aware of their impact, act consistently, and influence others to act.

At the start of the curve (inactives), consumers associate sustainability with extrinsic concerns: environment and atmosphere preservation, sustainable packaging, and community aid and human rights advocacy. As the curve moves toward passives and followers, consumers become concerned about eliminating plastic and reducing food, packaging, and production waste. Frontrunners in sustainability have intrinsic concerns, including personal health and nutrition and clean label claims such as no artificial ingredients, locally sourced, non-GMO, and organic.

In addition to differences in the consumer archetypes, sustainability demands vary by food category, with the most demand in dairy, meat, and their plant-based alternatives.

However, the research shows a gap between consumers’ desire to eat and drink more sustainably and actually doing it. The key barriers of price and knowledge prevent people from making more sustainable choices in the grocery store. Kerry believes the world is at a critical tipping point for sustainable nutrition and manufacturers have an important role in increasing access to more sustainable options and raising awareness about consumers’ roles in sustainability. A powerful way to strengthen sustainability is to use more sustainable recipes, ingredients, and manufacturing processes.

These findings have major implications for the food and beverage industry. While consumers have high expectations for sustainability, they also demand taste, convenience, and value. “Creating a sustainable food chain on a mass scale requires a fine balance between improving sustainability without compromising on these other key expectations,” states the report. “A mix of creativity, collaboration and technological innovation can deliver this balance.”