CHICAGO, Jan. 5, 2023 /PRNewswire/ — Today Conagra Brands, Inc. (NYSE: CAG) reported results for the second quarter of fiscal year 2023, which ended on November 27, 2022. All comparisons are against the prior-year fiscal period, unless otherwise noted.

Highlights

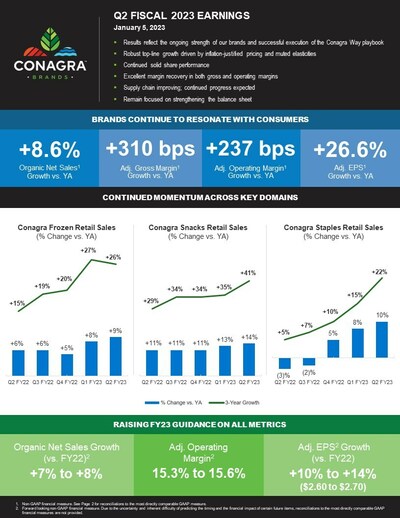

- Second quarter net sales increased 8.3%; organic net sales increased 8.6%

- Operating margin increased 320 basis points in the quarter to 16.6%; adjusted operating margin increased 237 basis points to 17.0%

- Diluted earnings per share (EPS) for the second quarter increased 38.6% to $0.79, and adjusted EPS increased 26.6% to $0.81

- The company is raising its fiscal 2023 guidance to reflect:

- Organic net sales growth of 7% to 8% compared to fiscal 2022

- Adjusted operating margin between 15.3% and 15.6%

- Adjusted EPS between $2.60 and $2.70 representing growth of 10% to 14% compared to fiscal 2022

CEO Perspective

Sean Connolly, president and chief executive officer of Conagra Brands, commented, “Our second quarter results reflect the ongoing strength of our brands and successful execution of the Conagra Way playbook as evidenced by our robust top-line growth, margin recovery, and earnings results. Our decisive actions to offset inflation coupled with improved service levels and productivity allowed us to successfully navigate ongoing inflationary pressures and industry-wide supply chain challenges as each segment delivered adjusted operating margin expansion in the quarter.”

He continued, “We are raising our fiscal 2023 guidance on all metrics – organic net sales growth, adjusted operating margin, and adjusted earnings per share due to continued positive business momentum and our strong first half performance. Looking ahead, we remain committed to executing on our strategic business priorities, including strengthening the balance sheet, as we continue our focus on generating value for our shareholders.”

Total Company Second Quarter Results

In the quarter, net sales increased 8.3% to $3.3 billion. The increase in net sales primarily reflects:

- a 0.3% decrease from the unfavorable impact of foreign exchange; and

- an 8.6% increase in organic net sales.

The 8.6% increase in organic net sales was driven by a 17.0% improvement in price/mix, which was partially offset by an 8.4% decrease in volume. Price/mix was driven by the company’s inflation-driven pricing actions that were reflected in the marketplace throughout the quarter. The volume decrease was primarily a result of the elasticity impact from inflation-driven pricing actions; however, the elasticity impact was favorable to expectations.

Gross profit increased 22.2% to $922 million in the quarter, and adjusted gross profit increased 21.7% to $933 million. Second quarter gross profit benefited from higher organic net sales and productivity, which more than offset the negative impacts of cost of goods sold inflation (including unfavorable commodity positions), unfavorable operating leverage, and continued elevated supply chain operating costs. Gross margin increased 316 basis points to 27.8% in the quarter, and adjusted gross margin increased 310 basis points to 28.2%.

Selling, general, and administrative expense (SG&A), which includes advertising and promotional expense (A&P), increased 7.9% to $373 million in the quarter and adjusted SG&A, which excludes A&P, increased 17.5% to $291 million driven by increased incentive compensation compared to the prior year quarter.

A&P for the quarter increased 10.3% to $79 million, driven primarily by increased investment in modern marketing, including social and digital platforms.

Net interest expense was $100 million in the quarter. Compared to the prior-year period, net interest expense increased 5.7% or $5 million, primarily due to a higher weighted average interest rate on outstanding debt.

The average diluted share count in the quarter was 481 million shares. During the second quarter, the company repurchased approximately 2.8 million shares of its common stock for approximately $100 million.

In the quarter, net income attributable to Conagra Brands increased 38.6% to $382 million, or $0.79 per diluted share. Adjusted net income attributable to Conagra Brands increased 27.9% to $392 million, or $0.81 per diluted share. The increase was driven primarily by the increase in gross profit and a strong performance from the company’s Ardent Mills joint venture.

Adjusted EBITDA, which includes equity method investment earnings and pension and postretirement non-service income, increased 21.5% to $710 million in the quarter, primarily driven by the increase in adjusted gross profit and a strong performance from the company’s Ardent Mills joint venture, slightly offset by lower pension income.

Grocery & Snacks Segment Second Quarter Results

Reported and organic net sales for the Grocery & Snacks segment increased 6.8% to $1.3 billion in the quarter.

In the quarter, price/mix increased 18.4% and volume decreased 11.6%. Price/mix was driven by favorability in inflation-driven pricing. The volume decrease was primarily a result of the elasticity impact from inflation-driven pricing actions. In the quarter, the company gained share in snacking categories including meat snacks and microwave popcorn, and staples categories including refried beans and canned meat.

Operating profit for the segment increased 36.6% to $340 million in the quarter. Adjusted operating profit increased 24.7% to $341 million as higher organic net sales and productivity more than offset the negative impacts of cost of goods sold inflation (including unfavorable commodity positions), unfavorable operating leverage, continued elevated supply chain costs, and increased SG&A.

Refrigerated & Frozen Segment Second Quarter Results

Reported and organic net sales for the Refrigerated & Frozen segment increased 10.5% to $1.4 billion in the quarter.

In the quarter, price mix increased 16.0% and volume decreased 5.5%. The price/mix increase was driven by favorability in inflation-driven pricing. The volume decrease was primarily a result of the elasticity impact from inflation-driven pricing actions. In the quarter, the company gained share in categories such as frozen single serve meals, plant-based protein, and frozen breakfast.

Operating profit for the segment increased 48.6% to $250 million in the quarter. Adjusted operating profit increased 37.1% to $259 million as higher organic net sales and productivity more than offset the negative impacts of cost of goods sold inflation (including unfavorable commodity positions), continued elevated supply chain operating costs, increased SG&A, and unfavorable operating leverage.

International Segment Second Quarter Results

Net sales for the International segment decreased 1.3% to $259 million in the quarter reflecting:

- a 3.4% decrease from the unfavorable impact of foreign exchange; and

- a 2.1% increase in organic net sales.

On an organic net sales basis, price/mix increased 12.8% and volume decreased 10.7%. The price/mix increase was driven by inflation-driven pricing. The volume decrease was primarily a result of the elasticity impact from inflation-driven pricing actions.

Operating profit for the segment decreased 0.6% to $37 million in the quarter. Adjusted operating profit decreased 0.9% to $37 million as the benefits from higher organic net sales and productivity were more than offset by the negative impact of cost of goods sold inflation (including unfavorable commodity positions) and unfavorable operating leverage.

Foodservice Segment Second Quarter Results

Reported and organic net sales for the Foodservice segment increased 14.8% to $283 million in the quarter.

In the quarter, price/mix increased 18.2% and volume decreased 3.4%. The price/mix increase was driven by inflation-driven pricing. The volume decline was primarily a result of the elasticity impact from inflation-driven pricing actions.

Operating profit for the segment increased 106.5% to $29 million and adjusted operating profit increased 53.4% to $29 million in the quarter as the benefits of higher organic net sales and productivity more than offset the impacts of cost of goods sold inflation (including unfavorable commodity positions) and unfavorable operating leverage.

Other Second Quarter Items

Corporate expenses increased 80.2% to $107 million in the quarter and adjusted corporate expense increased 44.4% to $102 million in the quarter driven by increased incentive compensation compared to the prior year quarter.

Pension and post-retirement non-service income was $6 million in the quarter compared to $16 million of income in the prior-year period.

In the quarter, equity method investment earnings were $49 million. The $20 million increase was primarily driven by favorable market conditions for the Ardent Mills joint venture, and the venture’s effective management through recent volatility in the wheat markets.

In the quarter, the effective tax rate was 24.3% compared to 23.4% in the prior-year period. The adjusted effective tax rate was 24.3% compared to 22.9% in the prior-year period.

In the quarter, the company paid a dividend of $0.33 per share.

Outlook

Due to a strong performance in the first half of the fiscal year, the company is raising its full year outlook for fiscal 2023. The company continues to plan for supply chain inefficiencies tied to the dynamic operating environment and also expects both gross inflation (input cost inflation before the impacts of hedging and other sourcing benefits) and results from its Ardent Mills joint venture to moderate through the remainder of the fiscal year.

The company’s updated fiscal 2023 guidance is as follows:

- Organic net sales growth is expected to be 7% to 8% compared to fiscal 2022

- Adjusted operating margin is expected to be between 15.3% and 15.6%

- Adjusted EPS is expected to be between $2.60 and $2.70, representing growth of 10% to 14% compared to fiscal 2022

- Capital expenditures of approximately $425M

- Interest expense of approximately $405M

- Adjusted effective tax rate of approximately 24%

- Pension income of approximately $25M

The inability to predict the amount and timing of the impacts of foreign exchange, acquisitions, divestitures, and other items impacting comparability makes a detailed reconciliation of forward-looking non-GAAP financial measures impracticable. Please see the end of this release for more information.

Items Affecting Comparability of EPS

The following are included in the $0.79 EPS for the second quarter of fiscal 2023 (EPS amounts are rounded and after tax). Please see the reconciliation schedules at the end of this release for additional details.

- Approximately $0.01 per diluted share of net expense due to fire related costs

- Approximately $0.01 per diluted share of net expense related to rounding

The following are included in the $0.57 EPS for the second quarter of fiscal 2022 (EPS amounts are rounded and after tax). Please see the reconciliation schedules at the end of this release for additional details.

- Approximately $0.02 per diluted share of net expense related to restructuring plans

- Approximately $0.07 per diluted share of net expense related to impairment of businesses held for sale

- Approximately $0.01 per diluted share of net benefit related to proceeds received from the sale of a legacy investment

- Approximately $0.02 per diluted share of net benefit related to legal matters

- Approximately $0.01 per diluted share of net expense related to rounding

Please note that certain prior year amounts have been reclassified to conform with current year presentation.

Discussion of Results

Conagra Brands will host a webcast and conference call at 9:30 a.m. Eastern time today to discuss the results. The live audio webcast and presentation slides will be available on www.conagrabrands.com/investor-relations under Events & Presentations. The conference call may be accessed by dialing 1-877-883-0383 for participants in the U.S. and 1-412-902-6506 for all other participants and using passcode 8026468. Please dial in 10 to 15 minutes prior to the call start time. Following the company’s remarks, the conference call will include a question-and-answer session with the investment community. A replay of the webcast will be available on www.conagrabrands.com/investor-relations under Events & Presentations until January 5, 2024.

About Conagra Brands

Conagra Brands, Inc. (NYSE: CAG), headquartered in Chicago, is one of North America’s leading branded food companies. Guided by an entrepreneurial spirit, Conagra Brands combines a rich heritage of making great food with a sharpened focus on innovation. The company’s portfolio is evolving to satisfy people’s changing food preferences. Conagra’s iconic brands, such as Birds Eye®, Marie Callender’s®, Banquet®, Healthy Choice®, Slim Jim®, Reddi-wip®, and Vlasic®, as well as emerging brands, including Angie’s® BOOMCHICKAPOP®, Duke’s®, Earth Balance®, Gardein®, and Frontera®, offer choices for every occasion. For more information, visit www.conagrabrands.com.